Key Points

- Biofuels play an increasingly important role in the energy transition by providing a low-carbon solution for hard-to-abate sectors such as trucking, shipping and aviation.

- In our view, renewable diesel stands out among biofuels as it can be used in all diesel-powered vehicles without modifying the engine, investing in new vehicles, or investing in new fueling equipment.

- With its superior environmental profile, robust policy support, and ongoing advancements, we believe renewable diesel is positioned to capture an increasing share of the biofuels market.

Biofuels are a renewable-energy source most commonly produced from plant or animal biomass (i.e., corn, soybean oil and animal by-products). These liquid fuels constitute a range of petroleum-diesel alternatives including ethanol, biodiesel and renewable diesel. Biofuels are mixed with petroleum in refineries to create more energy-efficient and carbon-friendly fuels for the transportation industry. While not novel, biofuels, and renewable diesel in particular, have received increased attention as climate-change concerns drive the pursuit of sustainable energy sources, especially with the net-zero goals of various states and companies.

Each category of biofuels possesses unique inputs, outputs, emissions profiles, constraints and policy implications. We believe that renewable diesel stands out as a particularly promising investment opportunity, not only for its favorable margins and lower carbon intensity, but also for the robust policy support it receives.1 Its integration is likely to have far-reaching effects on the transportation, energy, refining and trucking industries.

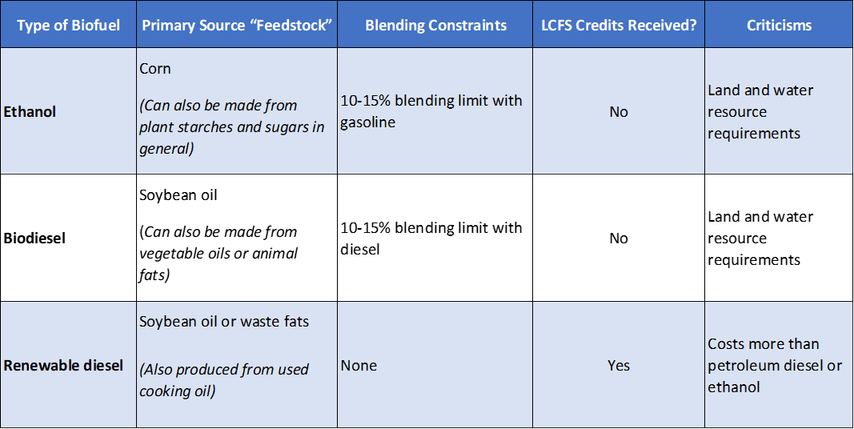

Types of Biofuels

Ethanol and biodiesel have long dominated the biofuels market, yet in recent years interest in renewable diesel has gained momentum. Rising demand for renewable diesel is a result of its ability to both integrate and completely replace petroleum diesel in vehicles, its superior environmental profile, and the supportive policy framework underpinning its production and use. Renewable diesel is chemically identical to petroleum diesel—the trucking industry’s primary fuel source—but releases up to 80% fewer emissions.2 Whereas ethanol and biodiesel can only typically make up 10-15% of a fuel mix, renewable diesel can be used on its own as a replacement fuel or blended with any amount of petroleum diesel.3

Environmental Impacts

The environmental ramifications of biofuels are an important component to consider in their viability as alternatives to fossil fuels, as well as their differences between one another. In our view, renewable diesel emerges as a frontrunner, with its lower carbon intensity and reduced emissions relative to its more controversial biofuel counterparts and conventional petroleum diesel.

The goal of reducing carbon emissions occasionally clashes with concerns about land-use dynamics and the potential for competition between biofuel production and food resources. We wrote about this issue in 2023. There are situations where production of all three biofuel variants can vie with food crops, namely corn and soybeans, for agricultural land and resources, potentially affecting the cost of food as well.4 Certain producers of renewable diesel only use animal by-products and discarded cooking oil as feedstock and stand out for their ability to use waste feedstocks, thereby mitigating concerns over land use and food competition.

Policy and Regulatory Landscape

Government policies and regulations play a crucial role in shaping the biofuels market by providing incentives and mandates to promote renewable-fuel production and use. The exponential growth in renewable-diesel consumption is largely a result of these incentives, especially given that it is more expensive to produce than other biofuels. As the environmental benefits of renewable diesel become increasingly apparent, we believe policymakers are likely to continue prioritizing its development and integration.

Key components, such as the Renewable Fuel Standard program, overseen by the Environmental Protection Agency, work to regulate biofuel blending. Another prominent biofuels policy is California’s Low Carbon Fuel Standard (LCFS), established in 2011. It is one of the primary programs in the state’s plan to cut greenhouse-gas emissions by improving vehicle technology and reducing fuel consumption.5 The LCFS program has led to almost all renewable diesel produced in the US being consumed in California, with consumption in the state growing from one million barrels to 28 million barrels per year between 2011 and 2021.6 Renewable diesel is well positioned to continue benefitting from blending mandates and incentives aimed at increasing the use of low-carbon fuels in the transportation sector.

Growth Potential

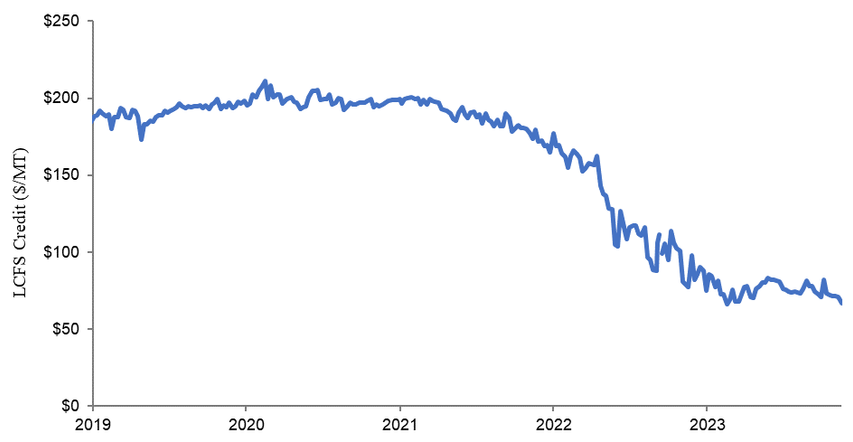

The LCFS credit is the mechanism by which California incentivizes emissions reductions in its transportation fuel pool. Renewable-diesel producers receive this credit based on the low emissions profile of the fuels they produce. The value of an LCFS credit has declined in recent years because emissions reductions have occurred faster than expected, as the rapid growth in renewable diesel generated a proliferation of credits. This suggests that the original LCFS initiative worked almost too well. To remedy this imbalance between the supply and demand of biofuels, we predict the LCFS will be changed to require producers to reduce emissions even further.

Low Carbon Fuel Standard Credit Values

The California Air Resources Board has already acknowledged that the current carbon price is not high enough to incentivize the level of clean investment it strives for. The Board has already proposed more stringent LCFS requirements, with a targeted $150 per ton LCFS credit value by 2025, versus the $67 per ton of today.7 So, the credit price must be higher to incentivize this more stringent carbon reduction plan. This increase in credit value could boost profits for renewable diesel producers, effectively increasing per-gallon margins by around 40%, with all other factors being equal.

Another potential area of growth for biofuel players is in the emerging Sustainable Aviation Fuel (SAF) market, which is enticing for industry participants due to a lack of alternatives to decarbonize the aviation sector. SAF is an alternative fuel for air transportation that is made from non-petroleum feedstocks designed to reduce emissions.8 Some producers have already begun converting existing capacity of renewable diesel to produce SAF instead. The SAF market offers the potential of significant margin uplift as well as entry into new sectors for those that capitalize on the opportunity. Currently, the development of SAF is more prominent in the European Union (EU) than the US given an EU-wide mandate beginning in 2025 that fuel uplift at EU airports must contain 2%+ SAF.9 There are not any mandates in the US currently, but airlines are voluntarily committing to incorporating SAF in the future, so we expect this to play an increasingly important role in the US in the coming years.

Broader Implications

Renewable diesel is an immediate way to decarbonize the transportation industry because users can utilize this fuel while keeping the same truck and engine, effectively reducing emissions with lower capital investment. With stricter LCFS requirements and the potential for increased benefits from LCFS credits, qualifying parties stand to gain even more. This potential for enhanced margins creates a compelling investment opportunity. Developments in the biofuels market extend beyond individual company gains, potentially affecting the broader energy market. Refiners may face the burden of higher costs associated with producing renewable diesel, but they can pass these costs along the supply chain, affecting consumers and industries such as trucking with higher shipping expenses. However, this shift towards renewable-diesel production could also have a positive impact on the refining market, as converting existing refining capacity to produce renewable diesel will further tighten the refining market, potentially leading to higher profits for those remaining focused in the petroleum diesel sector.

Conclusion

As the global energy transition accelerates, renewable diesel offers a pathway to decarbonize the transportation sector. With its superior environmental profile, robust policy support, and ongoing advancements, renewable diesel from waste feedstock is positioned to capture an increasing share of the biofuels market. Yet, the ripple effects of greater renewable-diesel production costs compared to other biofuels could be felt throughout the supply chain. However, the refining market may find itself in a favorable position, with traditional commodities remaining essential in the medium term, suggesting a tightening in the refining market ahead.

1 Source: Neste, Biodiesel vs Renewable Diesel: What is the difference? https://www.neste.us/neste-my-renewable-diesel/product-information/biodiesel-vs-renewable-diesel

2 Source: Darling Ingredients. https://www.darlingii.com/solutions/fuel/diamond-green-diesel

3 Source: US Department of Energy, Alternative Fuels Data Center. https://afdc.energy.gov/fuels/renewable-diesel#:~:text=Renewable%20diesel%20can%20be%20used,the%20Low%20Carbon%20Fuel%20Standard.

4 Source: Brittanica. https://www.britannica.com/technology/biofuel

5 Source: Californian Air Resources Board. https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/about

6 US Energy Information Administration. https://www.eia.gov/todayinenergy/detail.php?id=57180#:~:text=July%2020%2C%202023-,Almost%20all%20U.S.%20renewable%20diesel%20is%20consumed%20in,most%20isn’t%20made%20there&text=California%20accounts%20for%20nearly%20all,amount%20produced%20there%20in%202021

7 Source: Bloomberg, accessed on 4/29/2024.

8 Source: US Department of Energy, Alternative Fuels Data Center. https://afdc.energy.gov/fuels/sustainable-aviation-fuel#:~:text=Sustainable%20aviation%20fuel%20(SAF)%20is,reduces%20emissions%20from%20air%20transportation.

9 Source: International Trade Administration, European Union Aerospace and Defense Sustainable Aviation Fuel Regulation. https://www.trade.gov/market-intelligence/european-union-aerospace-and-defense-sustainable-aviation-fuel-regulation#:~:text=Beginning%20in%202025%2C%20fuel%20uplift,the%20EU%2C%20regardless%20of%20destination

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. MAR006246 Exp 06/29. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.