Key Points

- The market is once again expecting the Fed to aggressively cut interest rates in an attempt to salvage its economic “soft landing” and avoid a US recession.

- With this reset of interest-rate expectations, many investors are reevaluating their portfolio positioning, particularly across crowded trades, including the “Magnificent Seven” mega-cap businesses, artificial-intelligence stocks and US large-cap growth companies.

- We firmly believe that the days of free money are behind us and that companies and investors alike should consider this in their investment decisions.

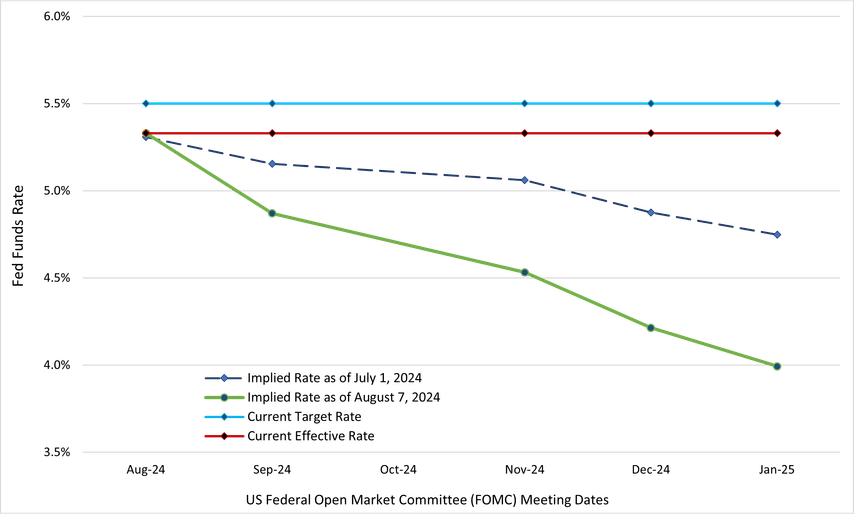

What a difference a month and a slew of fresh economic data can make. In early July, the market’s expectation for monetary policy finally started to align with the US Federal Reserve’s (Fed’s) guidance, following an extended period of dislocation. Cue the release of some softer economic data, and the market is once again expecting the Fed to aggressively cut interest rates in an attempt to salvage its economic “soft landing” and avoid a US recession.

Current Federal Funds Rate vs. Market-Implied Federal Funds Rate

Source: Newton Investment Management and Bloomberg, as of August 7, 2024.

A Swing in Equity Markets

With this reset of interest-rate expectations, many investors are reevaluating their portfolio positioning, particularly across crowded trades, including the “Magnificent Seven” mega-cap businesses, artificial-intelligence stocks and US large-cap growth companies. The readjustment has caused a meaningful swing across equity markets, with value outperforming growth and small caps outperforming large caps—a near reversal from the first half of 2024.

Relative Cumulative Returns Reverse in July

Source: Newton Investment Management and Morningstar, as of August 7, 2024.

A True Stock Market Rotation?

Is this the start of a true stock market rotation, or just a rebalancing? Time will tell. Meanwhile, we maintain our “balanced” approach to the market and value investing, particularly as the dispersion of potential outcomes remains quite high, in our view.

Stepping back from the immediate term, we believe that recent volatility can be partially attributed to a broader shift that the market and investors are making. This adjustment involves the ongoing normalization of inflation, interest rates and economic growth in the US—not to pre-pandemic levels, but to pre-global financial crisis levels. In other words, we expect inflation to be higher and more persistent than it was in the 12 years leading up to the pandemic, which may result in higher interest rates. Additionally, economic growth may regain some of its cyclicality, which had been depressed by extremely accommodative monetary policy. Speaking frankly, we firmly believe that the days of free money are behind us and that companies and investors alike should consider this in their investment decisions.

From an investment perspective, as fundamental, bottom-up stock pickers, we continue to view these macroeconomic factors through the lens of the companies in which we seek to invest. While we are undoubtedly monitoring the overall impact of macroeconomic events on the financial markets, we are even more keen to understand how these factors could affect individual companies. We are asking questions such as: how might our portfolio holdings perform if the Fed cuts rates once, or six times, over the next six months; how might a hard, soft or no landing for the US economy affect earnings and cash flows; and are we striking the right balance between offense and defense in the overall portfolio?

A Wider Dispersion of Returns

Similar to macroeconomic outcomes, this new environment is prompting a wider dispersion of returns among companies. As a result, we believe that fundamentals, valuations and business momentum should play a larger role in separating the winners from the losers. As always, we continue to favor companies sitting at the nexus of robust or improving fundamentals, attractive valuations and catalyst-driven business momentum.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. MAR006474 Exp 08/29. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.