Key Points

- Bond yields are now above rates of inflation with, we believe, good asymmetry (in favor of positive returns).

- We think ‘carry’ (the income from the excess or extra yield above the short-term cash rate or benchmark yield) currently gives bond investors a good degree of protection, with the potential for high returns.

- Central-bank policy aims to reduce inflationary pressures and should therefore be broadly positive for government bonds.

- The risk of financial-market dislocations is increasing, and we believe government bonds can offer some protection from that.

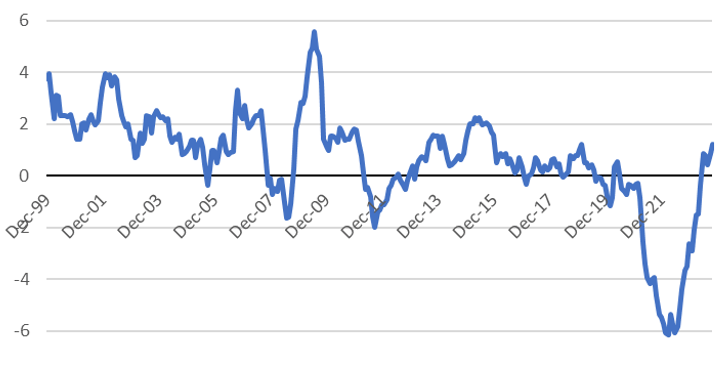

Want Yield More than Inflation?

After two years characterized by inflationary havoc and hawkish central banks, we believe the picture is finally changing for fixed-income investors. Bond yields in some countries are now above the level of inflation, including in the US, the largest bond market in the world, where ten-year government bonds now yield more than 1% above inflation (see chart below).

US 10-Year Treasury Yields Less Inflation (%)

Source: Bloomberg, October 31, 2023

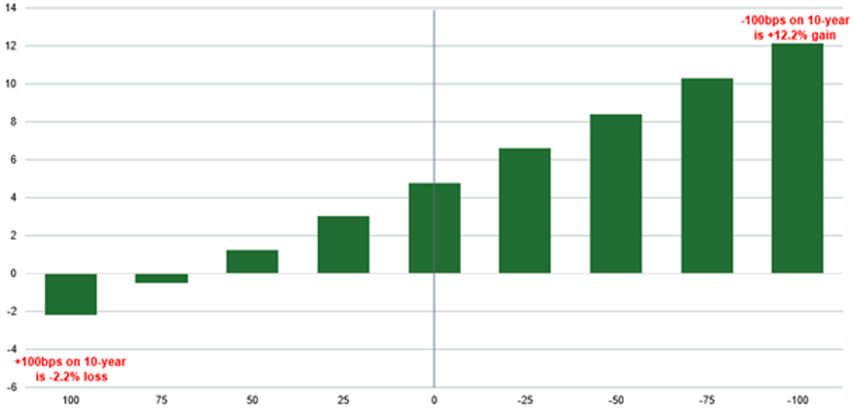

Carry and Downside Protection, with the Potential for Returns That Can Significantly Beat Cash

We believe it is bonds’ newly found yield that makes them an attractive investment prospect. In many cases, the holder will now receive significant ‘carry’, and this gives them a degree of protection if yields rise further; but if yields fall, positive returns can be significant. As the chart below shows, the potential returns on bonds are asymmetric, and even just a modest fall in bond yields will provide a better return than cash.

Total Return Scenarios for Changes in US 10-Year Yield (Assumes Parallel Shift in Yield Curve over One Year): Better Risk/Reward for Owning Bonds over the Next 12 Months

Source: Bloomberg, November 13, 2023

Over the last two years, bonds’ biggest nemesis has been sticky inflation, which, in the main, has been caused by labor markets remaining tight, which, in turn, has kept wage growth high.

For central banks to get inflation to fall back closer to their 2% targets, the most likely path is to force the labor market to loosen. Our view is that rising unemployment should lead to weakening wage pressures, which should, in turn, lead to falling inflation. This is a scenario in which government bonds come into their own, owing to their high credit quality and high positive sensitivity to falling inflation and yields.

Not All Bonds Are the Same: Plenty of Opportunities to Generate Returns

Bonds are issued in all shapes and sizes via both governments and companies, against a backdrop of very differing rates of inflation, fiscal positions/balance sheets and central-bank behavior. Inverted yield curves (where longer-dated bonds yield less than shorter-dated bonds) in many countries increase the need to be selective; why buy a bond that yields less than cash?

As fixed-income investors, we want to be buying bonds which fully compensate for taking those risks. We can avoid those countries (such as the UK, France or even the US) running large fiscal deficits, which are issuing large volumes of bonds, thus pushing yields higher.

Instead, we are seeing opportunities in countries where issuance pressure is lower, such as Australia or Denmark, and/or where inflation is lower, such as southeast Asian countries that are influenced by a weaker Chinese economy.

As we invest through this period which is dominated by fears about both inflation and recession, it is important that portfolios yield more than cash, and the carry, or income available from the excess or extra yield above the short-term cash rate, helps to get us through. With bond yields having risen markedly, we do not even need to take significant credit risk to unlock that yield.

Insurance against Recession but Get Paid While You Wait

We believe bonds can finally stand on their own two feet as a standalone investment. The largest global sovereign bond market (the US) now offers a yield above inflation, so bonds no longer require yield declines to generate a potentially attractive return.

However, bonds also still have recession protection in their back pocket; recession will weaken inflation pressures, allowing central banks to cut rates and fixed-income yields to fall, creating the potential, we believe, for significant returns on bonds.

Our view is that fixed-income investors should consider exposure to high-duration/high credit-quality strategies to take best advantage of this scenario. Such strategies should have the flexibility to move quickly to take advantage of changing bond market conditions. We recommend that investors consider increasing exposure to government bonds during times of economic stress and then subsequently move into high-yield bonds as conditions improve. Crucially, while we wait for economic pressures to ease, we believe that owning government bonds should deliver a yield for fixed-income investors well in excess of cash.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.