The UK Opportunities (Responsible) strategy was formerly referred to as the Sustainable UK Opportunities strategy. The strategy has been renamed in order to comply with naming and marketing rules under the UK Sustainability Disclosure Requirements.

Strategy profile

-

Objective

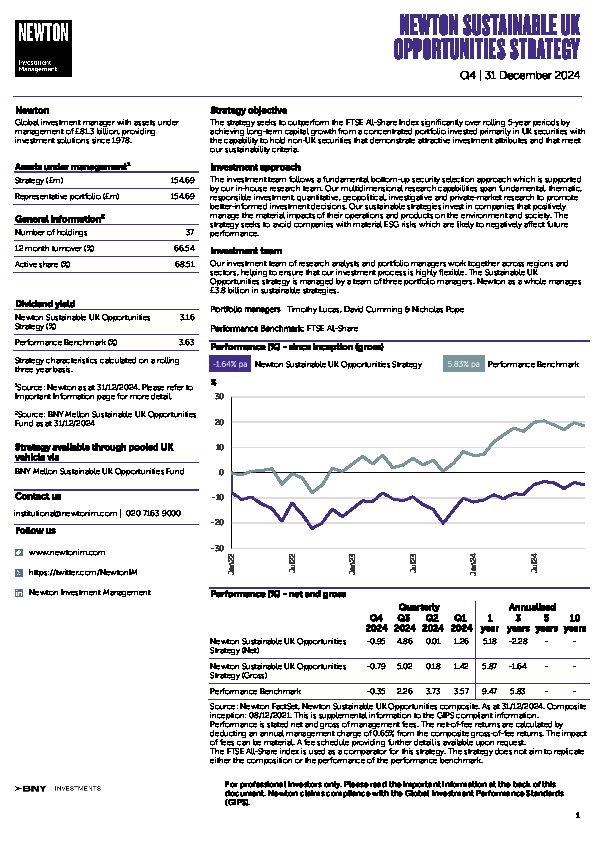

- The strategy aims to achieve capital growth over the long term (5 years or more).

-

Performance benchmark

-

FTSE All-Share*

-

Typical number of equity holdings

-

30 to 50

-

Sustainable investment restrictions

- Strategies that follow the Newton sustainable investment framework are subject to a set of minimum exclusions referred to as ‘sustainable investment restrictions’. These restrictions include companies involved in or that generate a material proportion of revenues from activities that are deemed to be harmful from an environmental or social perspective. Read more about our sustainable investment restrictions.

-

Strategy inception

-

8 December 2021

-

Strategy available through pooled UK vehicle

-

BNY Mellon UK Opportunities Fund (Responsible)

View fund performance

View Key Investor Information Document

View prospectus

View UK SDR Consumer Facing Disclosure -

- * The FTSE All-Share index is used as a comparator for this strategy. The strategy does not aim to replicate either the composition or the performance of the performance benchmark.

Investment team

The strategy is managed by an experienced team with a wide range of backgrounds and has dedicated support from Newton’s responsible investment team. In-house research analysts are at the core of our investment process, and our multidimensional research capabilities help to promote better-informed investment decisions.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

The strategy does not seek a specific sustainability outcome as part of its investment objective, but in pursuing its investment objective a minimum of 70% of holdings will be invested in securities assessed to have sustainability characteristics, in accordance with the Newton sustainable investment framework. This strategy does not have a UK sustainable investment label.