The Real Return (Responsible) strategy was formerly referred to as the Sustainable Real Return strategy. The strategy has been renamed in order to comply with naming and marketing rules under the UK Sustainability Disclosure Requirements.

Strategy profile

-

Objective

-

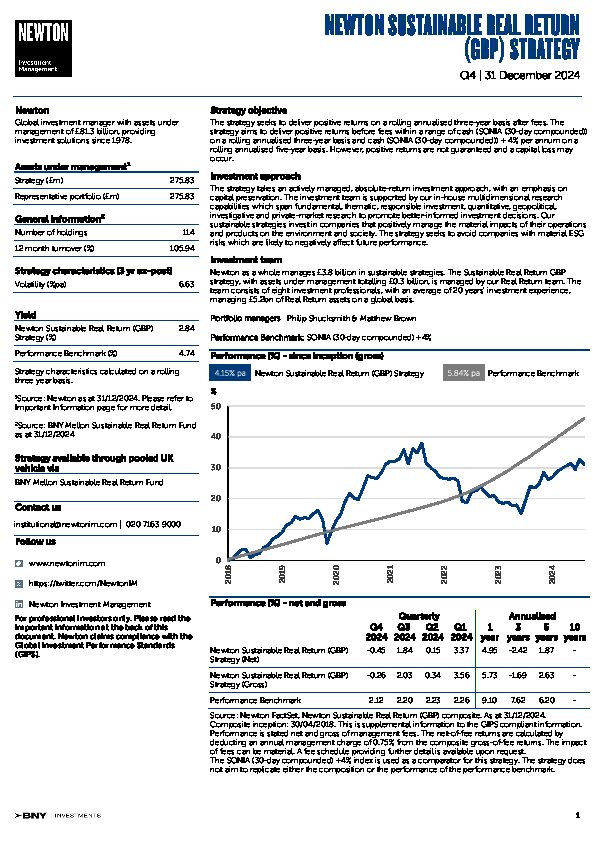

The strategy seeks to deliver positive returns on a rolling annualised three-year basis after fees. The strategy aims to deliver positive returns before fees within a range of cash (SONIA (30-day compounded)) on a rolling annualised three-year basis and cash (SONIA (30-day compounded)) + 4% per annum on a rolling annualised five-year basis. However, positive returns are not guaranteed and a capital loss may occur.

-

Performance benchmark

- The strategy will measure its performance before fees against SONIA (30-day compounded) on a rolling annualised three-year basis (the ‘three-year benchmark’) and SONIA (30-day compounded) +4% per annum on a rolling annualised five-year basis (the ‘five-year benchmark’).*

-

Volatility

-

Expected to be between that of bonds and equities over the long term

-

Sustainable investment restrictions

- Strategies that follow the Newton sustainable investment framework are subject to a set of minimum exclusions referred to as ‘sustainable investment restrictions’. These restrictions include companies involved in or that generate a material proportion of revenues from activities that are deemed to be harmful from an environmental or social perspective. Read more about our sustainable investment restrictions.

-

Strategy inception

-

Composite inception: 1 May 2018

-

Strategy available through pooled UK vehicle

-

BNY Mellon Real Return Fund (Responsible)

View fund performance

View Key Investor Information Document

View prospectus

View UK SDR Consumer Facing Disclosure -

- * Please note that on 1 October 2021, the performance benchmark for this strategy changed from 1-month GBP LIBOR +4% to SONIA (30-day compounded) +4%.

Investment team

The strategy is managed by an experienced team with a wide range of backgrounds and has dedicated support from Newton’s responsible investment team. In-house research analysts are at the core of our investment process, and our multidimensional research capabilities help to promote better-informed investment decisions.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

The strategy does not seek a specific sustainability outcome as part of its investment objective, but in pursuing its investment objective a minimum of 70% of holdings will be invested in securities assessed to have sustainability characteristics, in accordance with the Newton sustainable investment framework. This strategy does not have a UK sustainable investment label.