Strategy profile

-

Objective

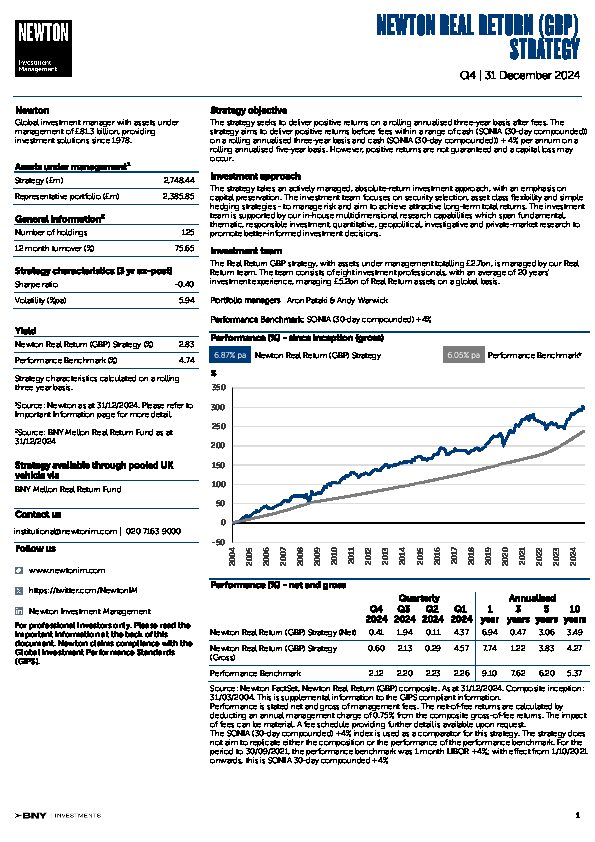

- The strategy seeks to deliver positive returns on a rolling annualised three-year basis after fees. The strategy aims to deliver positive returns before fees within a range of cash (SONIA (30-day compounded)) on a rolling annualised three-year basis and cash (SONIA (30-day compounded)) + 4% per annum on a rolling annualised five-year basis. However, positive returns are not guaranteed and a capital loss may occur.

-

Performance benchmark

-

The strategy will measure its performance before fees against SONIA (30-day compounded) on a rolling annualised three-year basis (the ‘three-year benchmark’) and SONIA (30-day compounded) +4% per annum on a rolling annualised five-year basis (the ‘five-year benchmark’).*

-

Volatility

-

Expected to be between that of bonds and equities over the long term

-

Strategy inception

- Composite inception: 1 April 2004

-

Typical assets

-

Selective exposure to

- Equities

- Corporate bonds

- Government bonds

- Cash derivatives

-

Other assets via tradeable securities

- Real estate

- Commodities

- Currencies

- Infrastructure

- Renewable energy

- Other ‘alternative’ strategies

-

Strategy available through pooled UK vehicle

-

BNY Mellon Real Return Fund

View fund performance

View Key Investor Information Document

View prospectus -

- * Please note that on 1 October 2021, the performance benchmark for this strategy changed from 1-month GBP LIBOR +4% to SONIA (30-day compounded) +4%.

Investment team

The strategy is managed by an experienced team with a wide range of backgrounds. In-house research analysts are at the core of our investment process, and our multidimensional research capabilities help to promote better-informed investment decisions.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.