Strategy profile

-

Objective

-

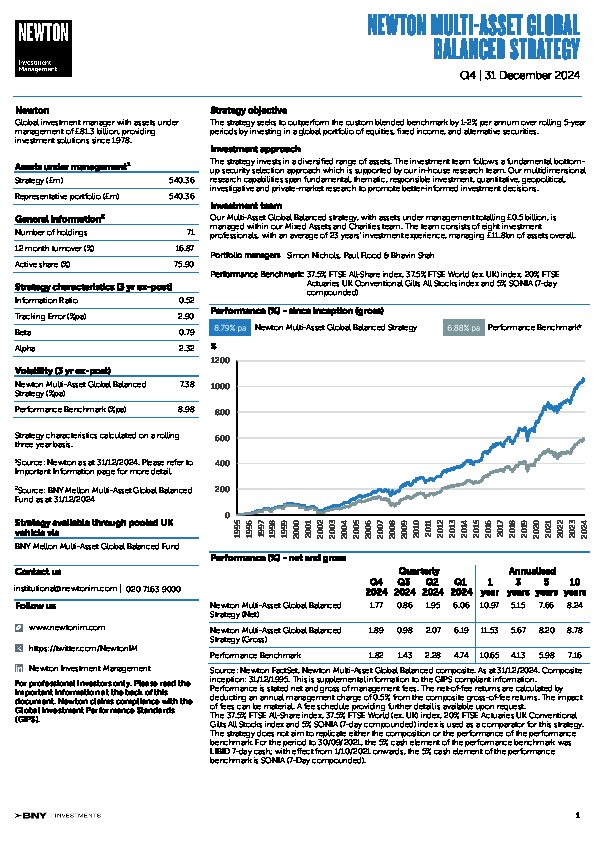

The strategy seeks to outperform the custom blended benchmark by 1-2% per annum over rolling 5-year periods by investing in a global portfolio of equities, fixed-income and alternative securities.1

-

Performance benchmark

-

37.5% FTSE All-Share index, 37.5% FTSE World (ex-UK) index, 20% FTSE Actuaries UK Conventional Gilts All Stocks index and 5% SONIA (7-day compounded)2

-

Typical number of security holdings

-

60 to 110

-

Strategy inception

-

22 September 1998 (BNY Mellon Global Balanced Fund).

Newton has managed UK Institutional Balanced strategies since its formation in 1978. -

Strategy available through pooled UK vehicle

-

BNY Mellon Multi-Asset Global Balanced Fund

View fund performance

View Key Investor Information Document

View prospectus -

-

1 The target stated is for indicative purposes only and may be changed without notice. Targeted return is generally aspirational in nature, is not based on criteria and assumptions, and is not a guarantee of future returns.

2 The 37.5% FTSE All-Share index, 37.5% FTSE World (ex-UK) index, 20% FTSE Actuaries UK Conventional Gilts All Stocks index and 5% SONIA (7-day compounded) is used as a comparator for this strategy. The strategy does not aim to replicate either the composition or the performance of the performance benchmark.

Investment team

The strategy is managed by an experienced team with a wide range of backgrounds. In-house research analysts are at the core of our investment process, and our multidimensional research capabilities help to promote better-informed investment decisions.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.