Strategy profile

-

Objective

-

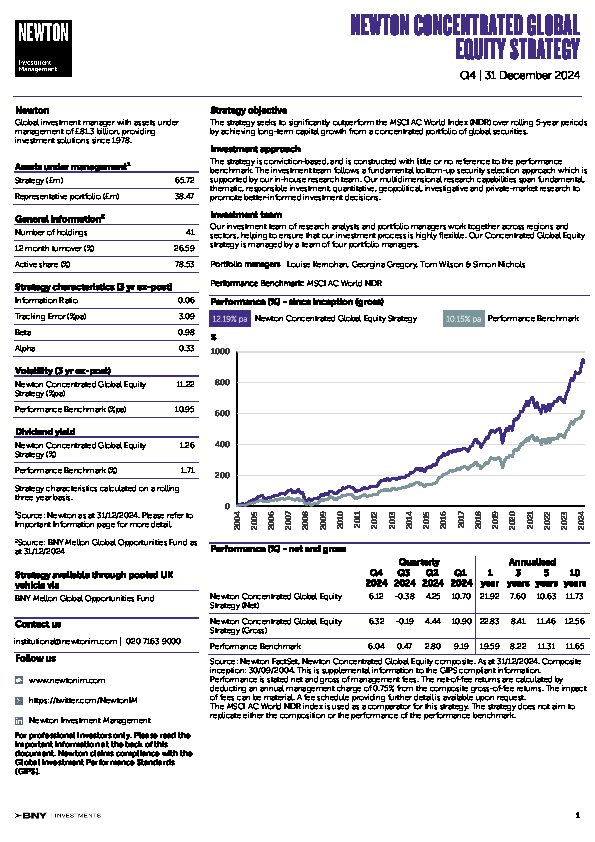

The strategy seeks to significantly outperform the MSCI AC World Index (NDR) over rolling 5-year periods by achieving long-term capital growth from a concentrated portfolio of global securities.1

-

Performance benchmark

-

MSCI AC World Index (NDR)2

-

Typical number of equity holdings

-

30 to 50

-

Strategy inception

-

Composite inception: 1 October 2004

-

Strategy available through pooled UK vehicle

-

BNY Mellon Global Opportunities Fund

View fund performance

View Key Investor Information Document

View prospectus -

-

1 The target stated is for indicative purposes only and may be changed without notice. Targeted return is generally aspirational in nature, is not based on criteria and assumptions, and is not a guarantee of future returns.

2 The MSCI AC World Index (NDR) performance benchmark is used as a comparator for this strategy. The strategy does not aim to replicate either the composition or the performance of the performance benchmark.

Investment team

The strategy is managed by an experienced team with a wide range of backgrounds. In-house research analysts are at the core of our investment process, and our multidimensional research capabilities help to promote better-informed investment decisions.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic structure the security has been assigned to.