Key points

- Trend-following strategies measure market sentiment by analysing recent historical returns.

- In our view, these strategies can be incredibly diversifying for investor portfolios owing to their low correlation to stock prices.

- While conventional trend following can be additive, we believe that the traditional recipe can be improved upon through the optimisation of signal processing.

Only one kind of ‘alternative’ strategy did well in 2022: ‘trend following’ or ‘managed futures’, which capture broad patterns of market sentiment, both bullish and bearish. In fact, some managed futures strategies were up over 70% last year.1

What is trend following?

Trend-following strategies measure market sentiment by analysing recent historical returns. Many consider the process to follow the tenets of human psychology. For example, if a portfolio was heavily underperforming last week, would an investor feel bullish or bearish this week? Most investors would probably feel bearish, and it turns out that, more often than not, this psychology can lead markets to continue their recent trajectory. Trends tend to be most persistent during times of significant market or economic upheaval, frequently when multiple asset classes are performing poorly. Consequently, trend following typically has its best opportunities when other investments are faltering.

In our view, trend-following strategies can be incredibly diversifying for investor portfolios. Historically, they have had zero, or even negative, correlation to stock prices—virtually no other easily accessible return stream has that characteristic. Additionally, trend following tends to do best in environments that are unfavourable for the balance of investor portfolios. From our perspective, this makes it an effective diversification tool for investors.

Improving on conventional trend-following methodology

While conventional trend following can be additive, we believe that the traditional recipe can be improved upon through the optimisation of signal processing by harnessing related-market information, disaggregating security-specific information from asset-class information, accounting for mean reversion in over-extended trends, and only investing where and when trends are found.

Concept 1: Harness information from related markets

Conventional trend-following strategies use the historical performance of a market to predict its future behaviour. For example, individual markets like West Texas Intermediate (WTI) crude oil, S&P 500® futures or US 10-year Treasury futures are each used to predict their own future direction, ignoring the historical behaviour of closely related markets like Brent crude oil, Russell 2000 or 10-year UK gilt futures.

In our view, a more nuanced approach incorporates information from related markets to predict future direction. For example, if there are five markets that are closely related to WTI crude oil, it could be more advantageous to include information from all of them to predict the future behaviour of WTI. This process creates the ability to look for common signals across a group of markets to predict the future direction of WTI. Ultimately, this approach enables the identification of more signal per unit of noise.

Concept 2: Disaggregate market returns with different time horizons

Recent returns from a set of related markets can provide information about asset class momentum as well as relative price momentum within the related markets. Asset class momentum and relative price momentum have opposite implications for future return when using shorter-term signals.

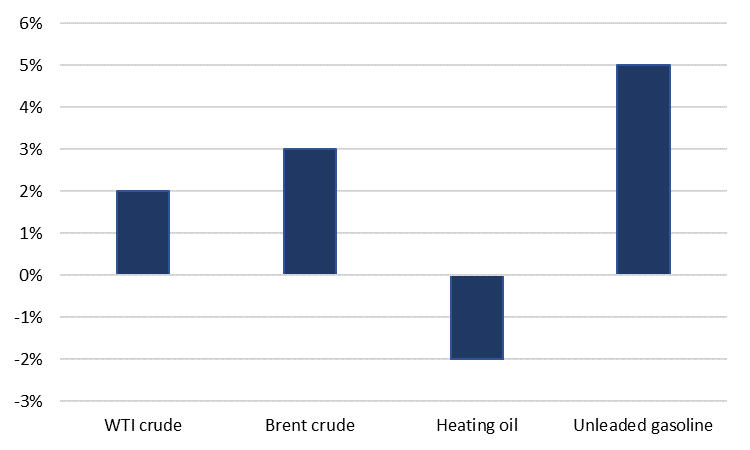

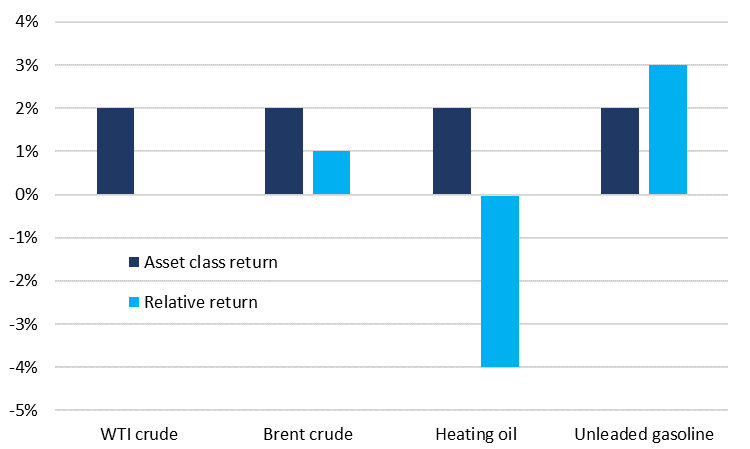

This information needs to be disaggregated to properly predict future market direction. As noted in the graphs below, we provide a theoretical example to disaggregate security-specific information from asset class information and model the time series behaviour of each separately.

Recent market return

Source: Newton, for illustrative purposes.

Disaggregated market return

Source: Newton, for illustrative purposes.

Concept 3: Mean reversion in over-extended trends

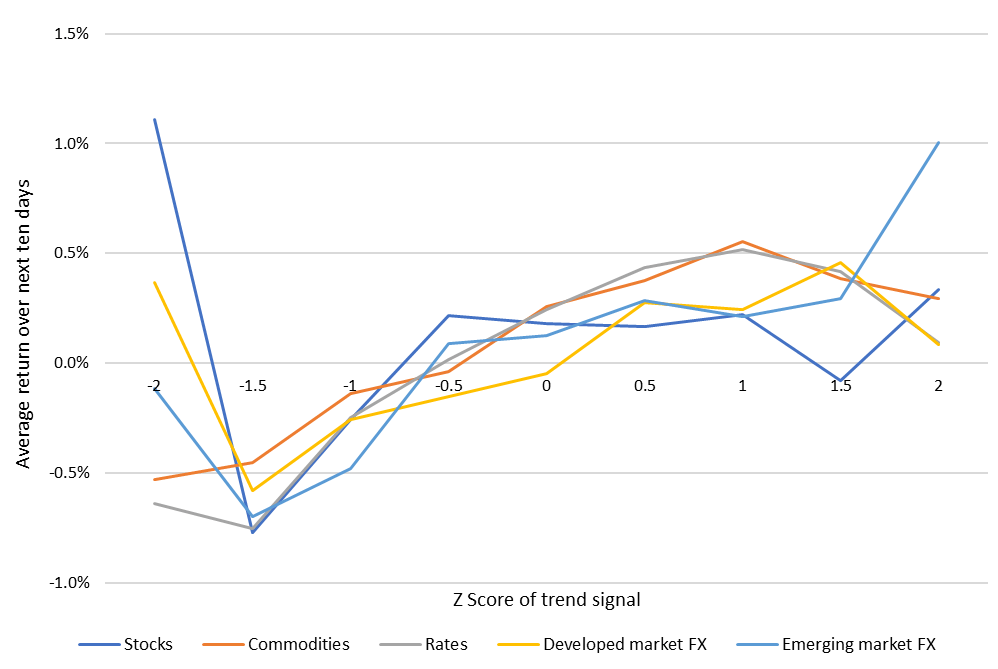

As a trend signal strengthens, the likelihood that it is caused by market noise falls, increasing the optimal position size in the trend.

At the same time, stronger trend signals are associated with larger recent moves, and large moves tend to predict future moves in the opposite direction. This argues for an optimal position that gets smaller when signals cross a specified threshold.

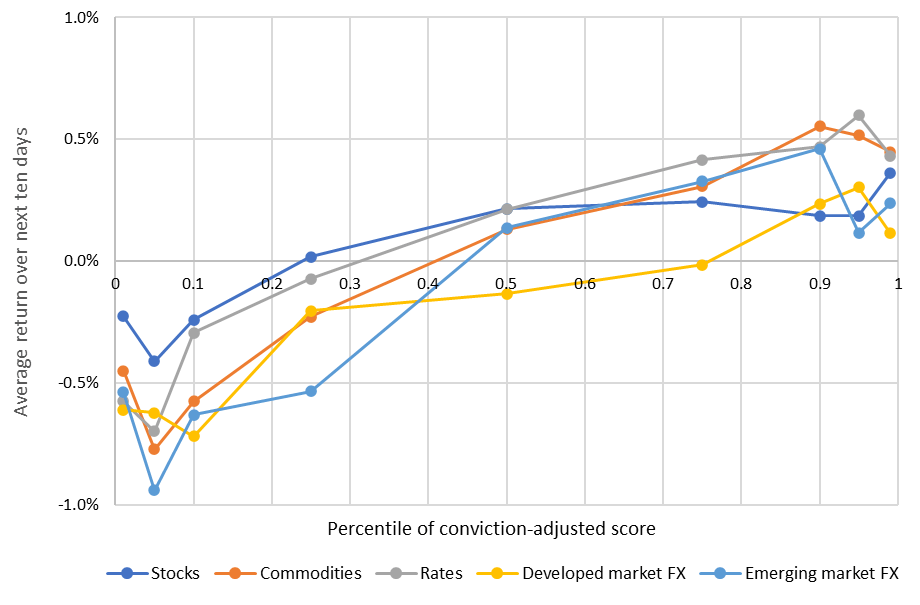

These opposing forces can make investing in short-term trends challenging. To solve this, we model these two dynamics separately, then combine them into an optimal position size.

Extreme trend signals can mislead

Source: Newton, for illustrative purposes.

Reversion-adjusted signals improve forecasting

Source: Newton, for illustrative purposes.

Concept 4: Only invest where and when there are trends

Many trend-following strategies employ a similar amount of risk at all times and allocate the same amount of risk to each asset class, regardless of the relative prevalence of trending opportunities. We believe a more thoughtful approach to signal-processing techniques can make signals even more informative. By concentrating the amount of risk based on where and when outsized signals are found, substantial risk may be avoided in markets where there is little evidence of trends.

Conclusion

In 2022, strong trends arose as the prices of stocks and bonds tumbled. In 2021, commodities rallied powerfully. In late 2020, the Covid pandemic buoyed several asset classes. In 2014, commodities were the winners of the day. In 2008 during the global financial crisis, most risk assets were halved. These time periods illustrate that market upheaval happens frequently, and a strategy that thrives in the most challenging environments can be particularly valuable in such instances. Furthermore, we believe conventional trend-following strategies can be improved upon through several optimisation concepts, allowing investors access to what we believe is a highly valuable diversification tool.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Important information

Issued by Newton Investment Management Ltd. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. In the United Kingdom, NIM is authorised and regulated by the Financial Conduct Authority (‘FCA’), 12 Endeavour Square, London, E20 1JN, in the conduct of investment business. Registered in England no. 01371973. Registered office: 160 Queen Victoria Street, London, EC4V 4LA, UK. NIM and NIMNA are both registered as investment advisors with the Securities & Exchange Commission (‘SEC’) to offer investment advisory services in the United States. NIM’s investment business in the United States is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. NIMJ is authorised and regulated by the Japan Financial Services Agency (JFSA). All firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY’).

Comments