As UK inflation returns to double digits, we expose the riskiness of cash and examine recent equity performance.

Key points

- UK inflation has returned to double digits.

- Given the inflation backdrop, term deposits might lead to large real-terms losses.

- Equity returns at least have the potential to outstrip inflation over time.

- We expect to see far greater disparity in the prospects for different stocks in future, highlighting, we believe, the importance of having a research-intensive approach and an understanding of investment themes.

I’m sure many savers heading towards retirement in the next decade will, at some point over the last ten years, have wished their bank interest rate was something a little more like what they dimly remember they received when they were young.

Be careful what you wish for, you might just get it!

On the surface, this autumn’s fixed-term deposit offerings appear to have granted those wishes. This, coupled with high levels of investment-market volatility, has made it tempting for many to make a switch from stocks to term deposits offering rates that were unthinkable even a few short months ago. However, those doing so in the belief they are reducing their risk may be in for a shock.

The insidious impact of inflation could well deliver a permanent loss of buying power. This could even be worse than holding onto investments that are exposed to the ups and downs of market volatility but offer some potential for long-term real gains, like equities.

What we need to understand is the real price of the stability offered by cash term deposits and whether that price is worth paying. If I have £100 today and lock it up in a two-year fixed-term deposit at 4.77% (the highest rate showing on Money Saving Expert at the time of writing),[1] I have a fair degree of certainty that, assuming I invest with an institution covered by the Financial Services Compensation Scheme and stay within the scheme limits, I’ll receive at least my money back and in all likelihood £109.77 in two years’ time.

However, will that have kept pace with inflation? Will it still be worth as much as £100 today?

In the years following the global financial crisis and leading up to the Covid-19 pandemic we became accustomed to cash deposits paying very little interest. However, one consolation was that for most of the period inflation was muted, and, overall, not too far from the Bank of England’s (BoE) 2% target.[2]

This environment meant that the value of deposits was slowly eroded year by year – a form of financial repression designed to encourage us to invest rather than hold cash. Of course, the inflationary backdrop has changed rapidly over the last 18 months as we emerged from the pandemic and faced fresh geopolitical challenges. Inflation rose and became entrenched, with central banks raising rates in an attempt to control it.

As a result, we cannot know for certain what inflation will be over the next 24 months, but we can get an idea of the risks involved in term deposits by looking at the situation today versus a year ago.

The bank with the top rate today offered only 0.6% per annum on its two-year fixed deposit two years ago.[3] Had you locked into that rate at the time, you would have just received £101.20 when you regained access to the money.

However, UK consumer price inflation (CPI) over the two years to September 2022 was 13.5%, so the purchasing power of your investment would have been eroded by over 12% in real terms, i.e. a painful and much more rapid erosion of real capital than experienced in the previous decade.

I doubt many investors would select an investment that guaranteed a loss of 12% over two years. Nor would they regard an investment where that kind of loss was a possibility as being ‘risk-free’.

So term deposits may not be volatile but can still serve up large real-terms losses.

How then can we evaluate their risk and reward today, in order to compare them with other types of investment available?

A starting point could be to look at the yield gap between fixed-rate and inflation-linked UK government bonds. This gap represents a market view of future inflation. Using this approach today, markets expect to see over 4.6% inflation a year over the coming two years.[4]

Interestingly, a year ago the market was expecting 4.4%.[4] So a year ago the market got its reading of the future badly wrong, given we have seen 10.1% inflation in just one year! This significant underestimation is perhaps understandable given the key drivers have been an unexpected war in Ukraine and the continuation of China’s zero-Covid policy. The former pushed up fuel prices, affecting everything that needs to be moved or uses power, and the latter has meant continued supply-chain disruptions.

Let us suppose, for a moment, that we are entering a period of geopolitical stability where no new shocks will occur, i.e. a rather pleasant fantasy! In such a world, the current contrast between the deposit rate and market expectation of inflation might actually be borne out in practice. You receive a 4.77% deposit yield that is offset by 4.6% inflation each year for the next two years. This means there is a (tiny) positive real yield available such that your £100 invested today might be worth £100.32 in real terms in two years.

The question is, do you think a 32 pence reward is worth locking up your money for, while being exposed to the risk that the pleasant fantasy evaporates in shocks that mean inflation once again turns out much higher that the market expects? No?

Of course, the shock might actually be that BoE policy proves effective and inflation is rapidly and decisively reined in to its 2% target. In this case, you might make as much as a 5.5% real return. However, if this is not your view of what is likely to happen, what else can you do?

Well, remember that a year ago the bank was offering only 1% per annum on a two-year fixed deposit, and the expected outcome over two years was a real-terms loss. Depositors accepted this expected negative real return only because at that time other assets looked to them to be unattractively pricey following their rapid post-Covid-19 recovery.

Today, most investments are priced very differently and potentially rather more attractively. Why? Because persistent post-Covid inflation was stoked by the Russian invasion of Ukraine and meant rapid rate rises from central banks leading to a repricing of risk assets like equities.

As a result, US large-cap equities have suffered a peak-to-trough fall of almost -24% within the last 12 months.[5] UK large-cap equities have also seen a fall (of -11%),[6] and this has been flattered by sterling’s rapid depreciation and the substantial overseas earnings of the firms in the index.

Of course, buying equities at lower prices does not guarantee strong long-term returns as markets can always sell off further. It does, however, bias the outcome more in your favour and, over the long run, developed-market equities have historically beaten inflation over most periods in excess of five years.

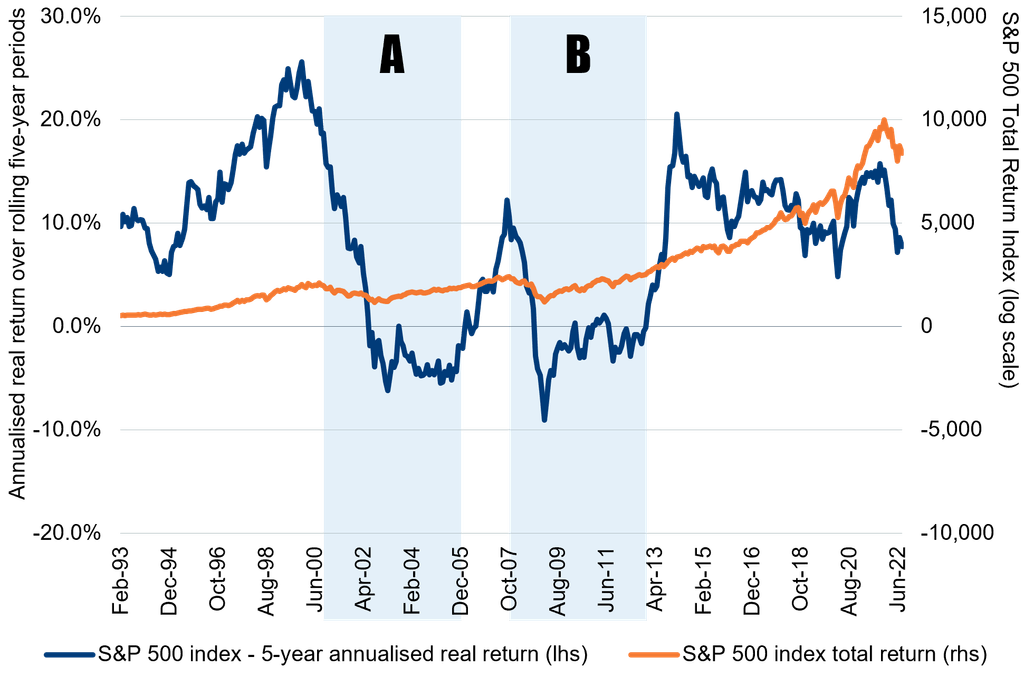

The chart below plots in blue the annualised real return over five-year periods of US equities going back to 1988. Noticeably, the line is mostly in positive territory, meaning that US equities beat inflation over most five-year intervals, sometimes substantially!

Superimposed in orange, for context, is the S&P 500 total return index (plotted on the right-hand axis). It is noticeable that the two periods, labelled A and B, in which the real returns were low (sometimes negative) corresponded with investment intervals that started just before market peaks – the dot-com crash and the global financial crisis – and ended afterwards early in the market recovery. By contrast, the peaks in real returns were generated in five-year periods that started in the preceding market trough (unsurprisingly).

S&P 500 index – rolling 5 year real return

Source: Yahoo Finance, 25 October 2022

So following this year’s market falls, if you are considering investing in equities, you might be biased towards looking at those sectors that have suffered the most.

The performance of high-growth US technology stocks – the so-called ‘FAANG’ stocks – was stellar during the Covid-19 pandemic as we all worked and shopped virtually. Likewise, their decline has been equally precipitous over the last 12 months. Perhaps these look temptingly cheap? Beware, however, that the regulatory landscape is changing for these behemoths, and some face stiff competition. Their advertising and subscriber-driven revenues are also likely to be lower in a slowing economy.

What we expect to see in future is far greater disparity in the prospects for different stocks; we are no longer in an environment where cheap money creates a rising tide that can lift all boats. Also, if history tells us anything, it is that in the aftermath of recessions, the new winners are not the same as those that came before. We believe this means that careful, active management can be particularly valuable, and that teams like ours, taking a research-intensive approach that incorporates consideration of long-term themes, have an opportunity to add material value.

[1] 24 October 2022, https://www.tescobank.com/savings/previous-interest-rates/

[2] Over 12 years from the end of 2008 to the end of 2021 UK CPI was 1.96% per annum.

[3] Tesco Bank, October 2020 see: https://www.tescobank.com/savings/previous-interest-rates/

[4] Bank of England 24 October 2022, see https://www.bankofengland.co.uk/statistics/yield-curves

[5] S&P500 Total Return Index was 9,986.7 at close on 27 December 2021 versus 7602.99 at 10 October 2022, Source https://finance.yahoo.com/quote/%5ESP500TR/history period1=568252800&period2=1666656000&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true

[6] FTSE100 was 7672.4 on 10 February 2022 then 6826.2 on 12 October 2022, Source:

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Important information

Issued by Newton Investment Management Ltd. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. In the United Kingdom, NIM is authorised and regulated by the Financial Conduct Authority (‘FCA’), 12 Endeavour Square, London, E20 1JN, in the conduct of investment business. Registered in England no. 01371973. Registered office: 160 Queen Victoria Street, London, EC4V 4LA, UK. NIM and NIMNA are both registered as investment advisors with the Securities & Exchange Commission (‘SEC’) to offer investment advisory services in the United States. NIM’s investment business in the United States is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. NIMJ is authorised and regulated by the Japan Financial Services Agency (JFSA). All firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY’).

Comments