Strategy profile

-

Objective

-

The Fund aims to generate capital growth and income growth over a period of 5-7 years by investing at least 70% of the Fund’s assets in a global portfolio of equities (company shares) and fixed-income securities (bonds).

-

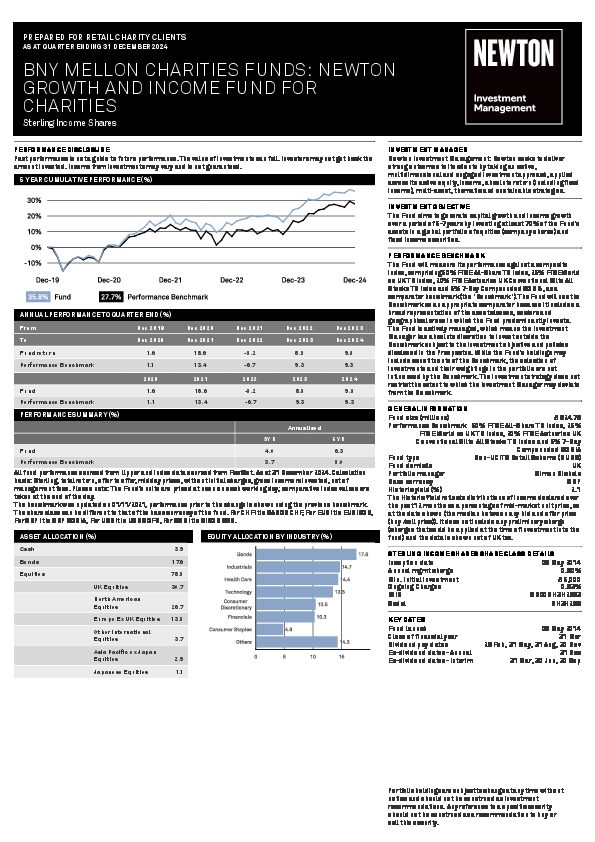

Performance benchmark

-

A composite index comprising 50% FTSE All-Share Index, 25% FTSE World ex UK Index, 20% FTSE Actuaries UK Conventional Gilts All Stocks Index and 5% SONIA (7-day compounded),* is used as a comparator benchmark (the ‘Benchmark’). The Fund will use the Benchmark as an appropriate comparator because it includes a broad representation of the asset classes, sectors and geographical areas in which the Fund predominantly invests. The Fund is actively managed, which means the Investment Manager has absolute discretion to invest outside the Benchmark subject to the investment objective and policies disclosed in the Prospectus. While the Fund’s holdings may include constituents of the Benchmark, the selection of investments and their weightings in the portfolio are not influenced by the Benchmark. The investment strategy does not restrict the extent to which the Investment Manager may deviate from the Benchmark.

* Please note that on 1 October 2021, part of the benchmark changed from 5% LIBID GBP 7-Day to 5% SONIA (7-day compounded). -

Literature

-

Investment team

The Newton Growth and Income Fund for Charities is managed by an experienced team. In-house research analysts are at the core of our investment process, and our multidimensional research platform spans fundamental, thematic, responsible investment, quantitative, geopolitical, investigative and private-market research to promote better-informed investment decisions.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Newton is not a tax expert and independent tax advice should be sought.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

ESG can be one of many inputs into the fundamental analysis. Newton will make investment decisions that are not based solely on ESG analysis. Other attributes of an investment may outweigh ESG analysis when making investment decisions. The way that material ESG analysis is assessed may vary depending on the asset class and strategy involved. As of September 2022, the equity investment team performs ESG analysis on equity securities prior to their recommendation. ESG analysis is not performed for all fixed income securities. The portfolio managers may purchase equity securities that are not formally recommended and for which ESG analysis has not been performed.