Key points

- Geopolitical uncertainty presents a key source of risk as the world becomes more divided.

- Inflation is not quite under control yet; however, we think the US Federal Reserve may deliver two interest-rate cuts later this year.

- 2024 is set to be the biggest year in history for elections, and the market is particularly focused on the US, where the outcome could have potential spillover to other economies.

- Amid this volatility, increased fiscal spending is creating investment opportunities.

Charity investors continue to face a variety of challenges. We have seen rising geopolitical tensions across the globe, which is a cause of concern for many charity investors. What are the investment implications of geopolitical risk, and are there any other threats you would highlight?

Last year was a very turbulent period for geopolitics, with rising tensions between the US and China and conflict flaring in the Middle East, in addition to the ongoing Russia/Ukraine war. The future of these conflicts is unknown and remains a key source of risk as the world becomes more divided.

The high level of global debt in an environment of elevated interest rates also presents a major concern.

Climate change is, in our view, one of the most significant threats, but also an area of opportunity, as much investment is needed to support the transition to a low-carbon economy.

What are your thoughts on the current market environment and on the inflation outlook?

A year ago, as shown in the latest Newton Charity Investment Survey, the biggest concern for charities was inflation. It was felt then that central banks would have to create a significant slowdown in order to get inflation back on target.

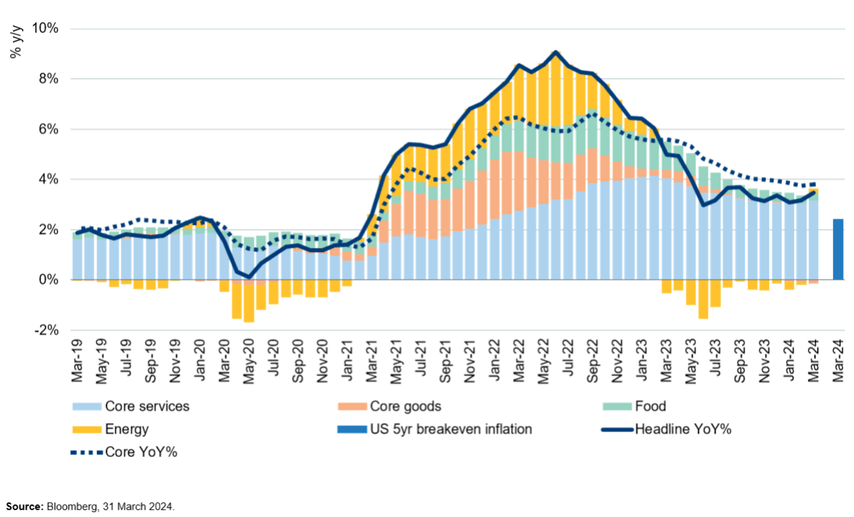

I think it is clear that the inflation genie has not quite been pushed back into the bottle yet, and it is too early for the US Federal Reserve (Fed) to declare victory and start cutting rates. The concern is that services inflation has not yet resumed a disinflationary trend, primarily owing to the stickiness of shelter and health-care prices, which are known to move with a lag, and wages are still elevated. Therefore, not enough economic slack has been created to start cutting rates, and with financial conditions still loose, the Fed has indicated an intent to keep US policy rates elevated for longer. We still think the Fed may deliver two rate cuts this year, but the timing is being pushed to the third and fourth quarters.

US consumer price index inflation

Increased fiscal spending has benefitted certain parts of the market, such as the industrial sector, over the last couple of years. What is the money being spent on?

There is significant fiscal spending currently taking place, and the US Congress has passed three infrastructure items since 2021:

1. Infrastructure bill

2. Inflation Reduction Act

3. CHIPS Act

In a nutshell, the Inflation Reduction Act targets clean energy and the CHIPS Act is intended to incentivise the research and manufacturing of semiconductors in the US. The stocks that are expected to benefit from this increased spending have been outperforming until recently. The US$550bn infrastructure bill was passed to provide investment into infrastructure such as roads, bridges and water. Since 2021, just 0.2% of US GDP has been spent on traditional infrastructure.[1] Stocks that are materially tied to general infrastructure spending have outperformed the S&P 500 by nearly 60% since the bill was passed in November 2021,[2] suggesting that this could be just the beginning in terms of macro and market upside.

2024 is set to be the biggest year in history for elections. What is the outlook given the significant number of elections?

The global election cycle is underway, with a number of consequential elections taking place this year across key countries including the US and the UK. The market is currently focused on the November US election given major policy divergence between leading candidates Donald Trump and Joe Biden, the size of the US equity market, and the potential spillover to other economies.

In the US, a Biden/Democratic party loss could lead to major changes in key areas such as fiscal policy, trade policy (especially between the US and China), foreign policy (given the conflicts in the Middle East and Israel, and in Russia and Ukraine), and regulation (associated with the environment and clean energy). It is nearly impossible to call the election outcome at this point in time as there is significant uncertainty and potential for a November surprise given that polls are predicting a close race for the presidency and the Congress.

All in all, the key sectors and themes that could be beneficiaries of the policies that the candidates are proposing are traditional sources of energy under a Trump administration, and health care and green energy if Biden remains in the White House.

Against this volatile backdrop, we expect sector rotation to continue depending on the outlook for growth, inflation and interest rates. However, our focus remains on quality; higher inflation means it is even more important to look for stocks that can benefit from structural growth trends and that possess strong, robust business models with pricing power.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

[1] Source: Strategas.

[2] Source: Strategas.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This is not investment research or a research recommendation for regulatory purposes. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. MAR006259 Exp: 06/2025.

Important information

Issued in the UK by Newton Investment Management Limited, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023.