Key points

- We believe the new political landscape could prove positive for the UK gilt market, as the inflationary impact of Russia’s invasion of Ukraine fades and a degree of stability and certainty returns to markets.

- The new government faces a tight fiscal situation, with a high debt-to-GDP ratio, elevated borrowing costs, and pledges to limit the scope for income-tax hikes.

- We believe the government will need to be prudent in its expenditure and may ultimately need to resort to other tax increases in the future.

- Ambitious plans to boost economic growth come via a significant housebuilding programme and a proposed national green energy fund.

- With near-term energy price rises a potential side effect of the green energy initiative, the government may need to convince the electorate that its plans will prove beneficial over the longer term.

The significant margin of victory achieved by the Labour Party at the recent UK general election was not a surprise, but how does it fit with our expectations for the UK’s gilt market and broader economy?

Overall, we anticipate that the new political landscape could prove positive for the gilt market over the near to medium term. Our view is that as the inflationary impact of Russia’s invasion of Ukraine continues to slowly roll out of the inflation data, the real yield now on offer from gilts looks more attractive than it has for some time.

UK growth has been anaemic despite a significant government budgetary overspend over the last few years. Labour ruled out income-tax hikes in its manifesto, and, now in power, the party is at great pains to explain that specific policies are ‘fully funded’, or ‘fully costed’. This indicates to us that the new government is wary of being labelled profligate as it may not receive the same leeway from much of the UK press as was afforded to its Conservative Party counterparts while in power. We anticipate that Labour may need to pick its expenditure battles wisely.

Spending constraint

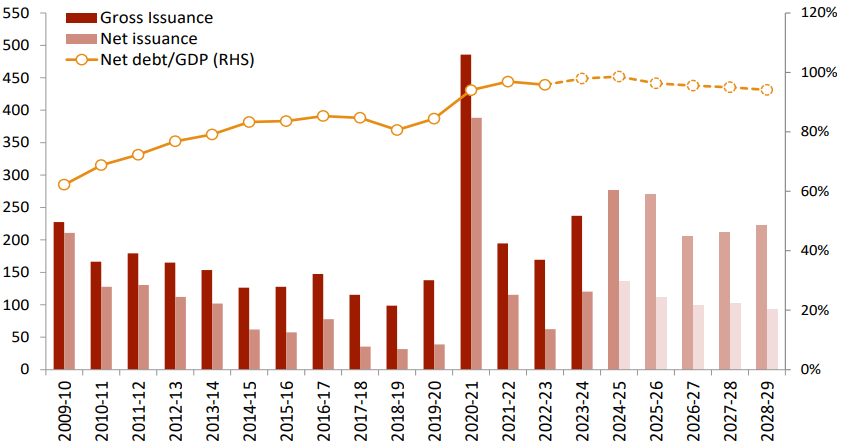

In the latest quarterly report from the UK Treasury Debt Management Office (DMO) we note that the UK’s projected annual financing requirements are likely to call for further spending constraint. The UK debt-to-GDP ratio is expected to peak in 2025-26, while gross debt issuance should peak in 2025 at around £300bn, with a projected net-debt issuance of around £125bn. This elevated borrowing programme, initiated by the previous government, is now being serviced at higher borrowing costs as interest rates have risen to try to counter the recent period of high inflation (see chart below).

UK annual financing requirements (£bn)

Source: DMO, Office for Budget Responsibility, 31 December 2023. Values based on Autumn Statement 2023 estimates and projections. Net issuance in the chart above is defined as gross issuance net of gilt redemptions.

We suspect that these governmental budgetary pressures may weigh on growth, rather than boost it. While there are other measures (such as the recent cut in National Insurance contributions) which may boost overall consumer spending, we expect these budgetary pressures to have a greater effect, which may, in turn, need to be offset by tax rises (ex-income tax) further down the line.

The fiscal cupboard is bare

Although Labour won a significant majority in the House of Commons, the fiscal cupboard is bare, which means the party is likely to be denied the ideal ‘honeymoon period’ often afforded to new governments. We suspect that the new government will continue to hammer home the message of just how bad the economic backdrop it inherited is and how it will take time to repair the damage, with Labour acting as a ‘new broom’.

However, the incoming government does appear to offer something that has been in short supply in the UK over the last decade, which is stability. Over the last few years, we have not only had a revolving door at 10 Downing Street, but also a high degree of churn in other offices of state and heads of departments. This new perceived stability of governance could ultimately lead to lower borrowing costs owing to greater stability of policy and of decision makers, and we expect it may afford investors greater predictability.

UK – a mixed economic bag

We have seen a mixed bag of UK data over recent weeks. Services inflation and wage growth (dominated by services numbers) have remained high, while the labour market is softening. With inflation hovering around the Bank of England’s 2% target, the bank may now be able to cut rates without facing significant resistance.

The UK interest rate is at 5.25%, a full 3.25% ahead of consumer price inflation, 1.75% more than core inflation, and almost 5% ahead of GDP (not to mention a long way above money supply growth). We think the UK’s policy rate could therefore be deemed restrictive, and struggle to see what might turn the UK’s growth trajectory around. Question marks remain over medium-term government expenditure, growth in the European Union (EU) – the UK’s main trading partner, and the prospect of US trade tariffs looming amid global growth concerns, which could all hit the UK’s open and mercantile economy.

Housing plans seek to boost growth

Aside from going for the low-hanging fruit, such as instigating a less fractious relationship with the EU, Labour is looking to boost growth by hanging its hat on a pump-priming strategy of extreme levels of house building. The new government’s target of 300,000 houses per year represents the highest level since 1979, when the new Conservative government of Margaret Thatcher heralded the end of large-scale local authority housebuilding.

Green energy developments

The new government also has ambitious plans to transform energy generation in the UK by setting up a national energy company called Great British Energy. This could become an interesting development over the next few years but comes during a period in which government levels of indebtedness are at generationally high levels.

The project seeks to protect the UK’s energy security, reduce carbon emissions and harness the untapped natural power sources at its disposal. The UK has ample wind, a huge length of coastline to tap tidal power, a reasonable degree of sunshine and world-leading academic and scientific institutions, at a time when the market for sustainable financing continues to grow.

Necessity is the mother of invention, and we are hopeful that the project could prove effective, but there is inevitably a cost to innovation and an inherent riskiness involved in seeking to achieve a first-mover advantage. We believe the new government needs to convince the UK population that while the cost/benefit analysis of establishing this initiative may produce an initial increase in energy bills to finance the change in energy mix, it should prove more beneficial over the longer term.

IMPORTANT INFORMATION

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. MAR006395 Exp 07/2029

General regulatory disclosures

Issued by Newton Investment Management Ltd. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. In the United Kingdom, NIM is authorised and regulated by the Financial Conduct Authority (‘FCA’), 12 Endeavour Square, London, E20 1JN, in the conduct of investment business. Registered in England no. 01371973. NIM and NIMNA are both registered as investment advisors with the Securities & Exchange Commission (‘SEC’) to offer investment advisory services in the United States. NIM’s investment business in the United States is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. NIMJ is authorised and regulated by the Japan Financial Services Agency (JFSA). All firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY Mellon’).

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments