Our ‘net effects’ theme has been a long-standing influence on our Global Emerging Markets strategy. Currently, over 30% of the strategy comprises stocks that are prospective beneficiaries of this long-term theme.

One reason for the large exposure is the scale of opportunities we see relating to the theme in a broad range of sectors, not simply traditional ‘tech,’ although we are selective within this. Types of applicable companies range from e-commerce to social networking, and also online recruitment and travel companies. The theme extends to leaders in the semiconductor area. Many sub-industries have consolidated to create oligopoly or duopoly markets, and, as new technologies like artificial intelligence create increased demand for semiconductors (e.g. memory chips), these leading companies are gaining pricing power to an extent they have never had before.

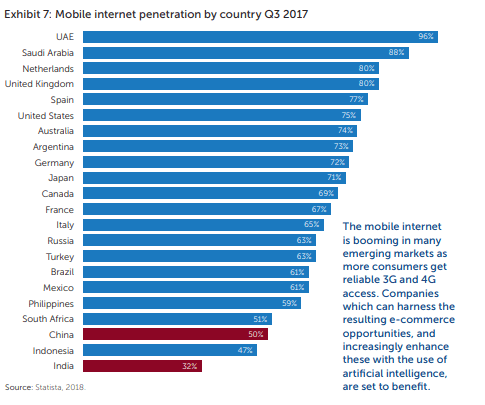

We regard Asia as a very exciting place to find beneficiaries of our ‘net effects’ theme. This stems from a few factors: population dynamics and rising income levels mean there is still a long ‘runway’ for growth. In India, for example, mobile internet penetration is only 32%.

Mobile internet penetration by country Q3 2017

Another favourable trend that ‘net effects’ identifies is the use of technology to leapfrog traditional bricks and mortar infrastructure and grow digitally from the start. This can happen in developing economies where the formalisation of many industries is still in its infancy.

The way the Chinese landscape has evolved perhaps epitomises the ‘net effects’ theme. Thanks to internet business Tencent’s social networks, called QQ and Weixin (also known as WeChat), and the availability of cheap handsets and affordable data, virtually the entire population is connected to one ecosystem through which almost every aspect of daily life is conducted and livelihood is created. Grocery shopping, food deliveries, bill payments, money transfers, video and gaming entertainment, e-commerce, social interaction, travel, business interaction… the list goes on. As the chief commercial officer of one luxury online fashion retailer put it, “practically everything in China happens on WeChat”.[1]

The ‘net effects’ theme can be seen in action as companies spring up on the back of Tencent’s infrastructure. Pinduoduo is a social e-commerce company with a unique ‘team-buying’ concept. It was launched in 2015, but already has almost 300 million users thanks to the way referrals to friends and family happen via QQ and WeChat. Luckin Coffee is another example – launched in November 2017, it already has 525 cashless stores, over half of which are solely for fulfilment of delivery orders.

As ‘net effects’ are happening in every industry, the upshots of this theme are growing. They are perhaps most visible in retail, where online leaders are now taking control of their offline counterparts in what is popularly called OMO (online merged with offline), but also in finance and health care for example.

As this wave of disruption rolls on, regulation catches up and this introduces risks to the theme. We have recently seen the People’s Bank of China crack down on online finance platforms. And the idea of data privacy – now well known in the US and Europe – is rapidly evolving in China and other emerging markets. This means we remain very selective in our investment approach. We note in particular that private-equity capital continues to pour into this space, resulting in a vast number of IPOs as the private-equity firms look for an exit, and we see a potential bubble in the making. However, we believe there could be attractive opportunities over time for long-term investors.

[1] https://www.bloomberg.com/news/articles/2018-07-19/farfetch-buys-china-agency-to-bring-luxury-brands-to-wechat

This is a financial promotion. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments