Key points

- Last year, the Tokyo Stock Exchange (TSE) announced stricter listing requirements and disclosure rules, with the aim of reversing the ‘value-trap’ reputation of the Japanese market.

- The TSE’s request for companies to disclose their plans to improve their capital efficiency has been misinterpreted by some as a focus simply on the price-to-book ratio (PBR).

- The changes have been somewhat effective in driving up the volume of disclosures, but the quality of disclosures generally leaves much room for improvement, in our view.

- However, disclosure alone will not be sufficient to change valuations; companies will have to appropriately assess and act on the reasons for current valuation levels.

What do recent reforms mean for Japanese companies?

Japanese corporate governance reforms have generated significant market interest over the years. These reforms have included the adoption and subsequent revisions of the stewardship code and corporate governance code which promoted board independence and diversity, and aimed to make boards more accountable and increase alignment with shareholders. Both domestic and international investors have closely followed market developments with the view that changes in disclosures, governance practices and corporate structures could improve the relatively lower valuations of Japanese stocks and attract investors to the region.

The updates to listing requirements announced in 2023 have again attracted attention. The Tokyo Stock Exchange (TSE) has tightened its listing criteria, encouraged companies to disclose plans to increase their capital efficiency, and announced stricter rules around diversity, disclosure and sustainability. The aim of the TSE reforms is to reverse the long-held ‘value-trap’ reputation of the Japanese market by urging listed companies “to be proactive in enhancing medium- to long-term value”1 and ultimately to attract global investors. To support this, the TSE also ruled that the companies listed in its top-tier ‘Prime’ market should make key disclosures simultaneously in English and Japanese from March 2025.

The disclosures on increasing capital efficiency are not a mandatory requirement, and there is no punishment imposed on the companies that fail to provide these details. However, the TSE is using an approach that is likely to encourage companies to make these disclosures voluntarily, such as sharing anonymous case studies online, highlighting strong disclosures, and publishing lists of disclosers. Next, it plans to broaden its scope to call out poor quality disclosures. With companies keen to be seen as setting a good example, this approach by the TSE may prove to be effective in the long run.

During a research trip to Japan, members of our responsible investment team and their Japan-based investment colleagues met the TSE, alongside other companies, to better understand the potential investment implications and opportunities associated with the change and to provide investor feedback from both Japanese and global perspectives.

Misplaced focus on PBR1

One of the most interesting takeaways of our research was that the TSE reforms have been misunderstood in some ways, both domestically and internationally. The TSE’s drive to encourage companies to prioritise their capital efficiency and to increase their book value seems to have been interpreted by parts of the market and the media as a focus on just one measure – the price-to-book ratio (PBR). Following the TSE’s announcements, ‘PBR1’, which refers to the PBR of companies for which the ratio is below 1, has become a buzzword. While the PBR has been highlighted because it is easy to understand, the TSE is not intending to mandate one measure or a specific threshold (such as a PBR of less than 1). There is a misperception that if a company’s PBR is above 1, it is not necessary to meet the request to “take action to implement management that is conscious of cost of capital and stock price”.2

This focus on the PBR appears somewhat misunderstood because the desired outcome is to drive growth and higher valuations in the Japanese market, and therefore requires the consideration of a broader range of financial measures. Companies should decide and concentrate on what is relevant to their business. For example, the TSE has highlighted the PBR, return on invested capital (ROIC), weighted average cost of capital (WACC) and return on equity (ROE) as relevant measures. At Newton, we use PBR1 not as an end goal, but as a starting point for analysis. Furthermore, our investment team compares the ROE and ROIC across companies, in addition to reviewing the action plans the companies have disclosed to improve these measures. Finally, the TSE is targeting all companies and not just those with a PBR below 1 or with lower capital efficiency. Over time, there has been an increase in companies with a PBR of greater than 1 disclosing their plans, suggesting that this misunderstanding is gradually being resolved in Japan.

How effective have the reforms been?

The changes have been somewhat effective in driving up the volume of disclosures (at around 60% for the Prime market), but the quality of disclosures generally leaves much room for improvement, in our view. It appears that many companies have rushed into disclosing their plans to improve their capital efficiency without first having taken the time to analyse their business. A company may have a low valuation for a number of reasons, and it is good business practice for the management and the board to identify the reasons for the low valuation before pushing forward a solution. There is an open question as to whether companies, in particular smaller companies, currently have the appetite or the resource to perform this analysis thoroughly.

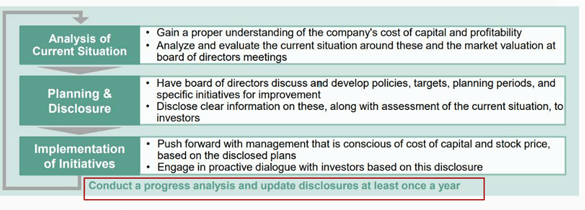

Actions required to achieve management that is conscious of cost of capital and stock price

Source: Japan Exchange Group, Inc., 2024.3

Moreover, when implementing any changes, there is a balance to be struck between applying pressure on companies and avoiding a sharp response. Effectiveness often comes down to enforcement. In this instance, investors holding companies to account will be key. We believe that the success of these reforms will, in large part, be determined by how rigorously investors, both Japanese and global, assess the disclosures that the companies make and what details the investors demand of the investee companies. For example, if investors ask questions about the robustness of companies’ plans to increase their book value, it may encourage investee companies to be thorough in their assessment of their own business.

Not just a box-ticking exercise

While the TSE and regulator are placing increasing emphasis on efforts like disclosure reforms, in our opinion it is not a simple fix to address what we perceive to be a market discount. There is a risk that these reforms end up being a box-ticking exercise instead of having the intended effects. A significant structural change in company valuations will require incremental but widespread change, and we expect this to be slow moving and to require persistent efforts over the longer term. Disclosure alone will not be sufficient to change valuations; companies will have to appropriately assess the reasons for current valuation levels. In addition, isolated regulatory disclosures will be insufficient. Management and investor relations teams must be able to consistently articulate the ways in which they are responding to such reforms during investor outreach and in written materials. The use of dividends and buy-backs may affect valuations in the short term, but long-term investors will be assessing the cost of capital, restructuring and investments to enable future growth.

Sources:

- Publication of Revised Japan’s Corporate Governance Code, Japan Exchange Group, 11 June 2021: https://www.jpx.co.jp/english/news/1020/20210611-01.html

- TSE to Publish a List of Companies That Have Disclosed Information Regarding “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price”, Japan Exchange Group, 26 October 2023: https://www.jpx.co.jp/english/equities/follow-up/uorii50000004sse-att/o4sio70000000mi4.pdf

- Reminder Regarding the Criteria for Inclusion in the List of Companies That Have Disclosed Information Regarding “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price”, Japan Exchange Group, 29 March 2024: https://www.jpx.co.jp/english/equities/follow-up/uorii50000004sse-att/dh3otn0000004cnc.pdf

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. MAR006519 Exp 08/2029

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments