Could advancements in gene sequencing technology accelerate scientific breakthroughs and provide attractive investment opportunities for years to come?

Key points

- Technological advancements have boosted the speed of sequencing, enhanced its accuracy and lowered costs meaningfully.

- We believe the total addressable market for gene sequencing is poised to grow an average of 10% to 20% per year over the next 15 years.

- In our view, significant demand for sequencing tests should more than offset pricing pressures and may ultimately lead to the continuation of high growth in the sequencing market through 2040.

The human genome is the playbook by which the human body functions. As such, the ability to read and understand the human genome is imperative to research on human health and disease management. Current in-depth knowledge about the human body—which is considerable, yet by no means complete—is largely attributable to the introduction and evolution of deoxyribonucleic acid (DNA) sequencing technology.

After years of dramatic expansion in this revolutionary space, bearish investors are concerned that the genetic sequencing market is nearing saturation and that growth is reaching a plateau, particularly as innovation and competition drive prices lower. However, gene sequencing technology continues to advance at a brisk pace. Additionally, the demand for DNA sequencing information continues to climb, and a myriad of new applications are still in nascent stages of development. Backed by the careful and comprehensive analysis of our multidimensional research platform, we believe the total addressable market for gene sequencing is poised to grow by an average of 10% to 20% per year over the next 15 years. In our view, this cutting-edge market could provide scientific and medical breakthroughs, as well as attractive investment opportunities, for years to come.

What is genetic sequencing?

Our complete set of DNA is referred to as our genome. Found in nearly every cell of a human body, DNA carries the instructions for synthesising proteins, which are responsible for all the ways in which our bodies develop and function. Through a process called transcription, the genetic code stored in DNA is transferred into ribonucleic acid (RNA). RNA, which acts as DNA’s messenger, carries that code to an area of the cell that serves as a protein building-block factory, and through a process called translation, proteins are created.

A DNA molecule is comprised of two adjoining strands that form a long spiral, or the familiar double-helix structure. These strands, which are linked together by hydrogen bonds, each contain a combination of four chemical building blocks, or bases—adenine (A), cytosine (C), guanine (G) and thymine (T). These bases exist in pairs, with A always pairing with T and C always pairing with G. The sequence of these base pairs dictates the genetic information that a DNA molecule carries.

DNA sequencing is the process by which scientists read the exact order of base pairs across a DNA segment or an entire genome.[1] To do this, scientists take a DNA sample (of blood, for instance) and put it through a sequencer, which is the instrument used to read the sample. The sequencer produces an output that appears as a string of As, Cs, Gs and Ts, corresponding to each particular base’s position in the DNA strand. As bases exist in pairs, sequencers only need to read one strand of the DNA molecule.

Scientists can take a DNA sequencing readout and compare it to a ‘normal’ reference genome to determine how it differs and if those differences are causing specific diseases or conditions. Today, sequencers are used in many different types of laboratories, ranging from small academic research labs and large core research labs to clinical labs located in hospitals.

Revolutionary advancements in gene technology

DNA sequencing technology is not new; early iterations can be traced back to the 1970s. However, in its earlier stages, sequencing was slow, expensive and far less accurate than it is today. More recently, technological advancements have boosted the speed of sequencing, enhanced its accuracy and lowered costs meaningfully—by over 100,000 times since 2001.[2]

Much of this improvement can be attributed to market leader Illumina. By 2014, Illumina had established a foothold in the market, securing 70% of the market share and generating 90% of all DNA data produced globally.[3] Today, while Illumina remains a dominant force, owing to its continual innovation and ability to target different segments of the industry, several other viable competitors have emerged. These newer participants are focused on various factors, including innovative new software tools and newer products that reduce the costs of sequencing. Continued competition in the space may pressure sequencing prices to decline further and lead to more cost-efficient and sustainable technological improvements.

DNA sequencing applications

As gene sequencing has progressed, its range of applications has significantly expanded—and many of the applications today would have been unfeasible at the pace, cost and accuracy of sequencing technology years ago. Currently, researchers and clinicians are using DNA sequencing for a number of applications, including discovery and translational research, clinical trials, population health, newborn screening and molecular diagnostics.

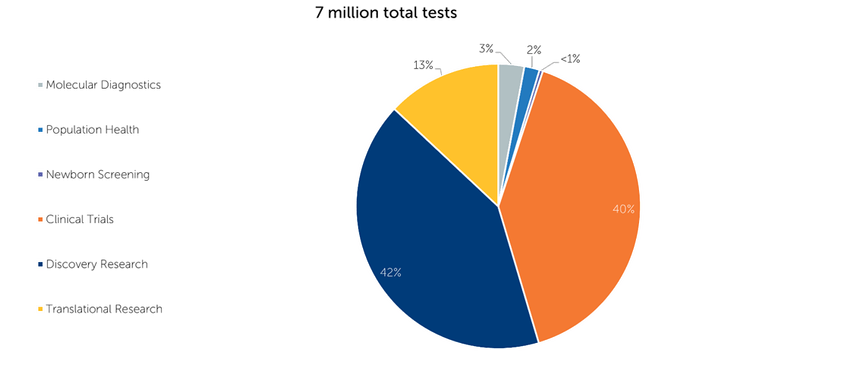

Gene sequencing tests by use case (2022)

Some applications are much more established than others; however, with continued advancements in the field over time, we expect the makeup of the market to shift dramatically over the next 15 years.

Today, clinical trials and discovery research comprise the lion’s share of the DNA sequencing market. In contrast, emerging applications like molecular diagnostics make up less than 4% of all sequencing tests run today. We believe that the established sequencing market should continue to grow, but the emerging applications should grow at a much higher pace. Over the next 15 years, we may see a shift in the market where areas like discovery research and clinical trials no longer make up the majority of sequencing volumes. These more mature markets may grow at a slower pace than they have done historically, but we believe the newer use cases should more than offset this slowdown, thus driving the overall sequencing market growth.

Newton’s sequencing model

The DNA sequencing market size estimates and models available today are typically expressed in dollar amounts. However, it is also beneficial to consider what could happen to the sequencing test volume as the technology continues to advance, and what the demand may be if price was not a factor. To do so, we leveraged the expertise of our multidimensional research platform—particularly our private markets, investigative research and research associates teams—to build our own model.

The model we constructed forecasts the volume of gene sequencing tests that could be demanded each year through 2040. It also breaks down these volumes by application. Members of our private markets team identified innovative private companies in the space and met these companies to better understand what the market is currently missing and what their specific technologies aim to improve. Our investigative research team, comprising former investigative journalists, sought researchers and clinicians using sequencers in their day-to-day work. They interviewed them to explore how they are using the instruments, how much more they might use the instruments if prices were to drop further, and their chief complaints about the technology. Our research associates helped us compile the information and create a dynamic model incorporating multiple inputs for each specific use case.

Conclusion

DNA sequencing has reached the point where cost is no longer an inhibiting factor and the accuracy and speed of the instruments on the market have significantly improved. Today, running DNA sequencing tests is efficient, and most importantly, the outcomes are useful and reliable.

As genetic sequencing technology continues to advance over time, we believe the uptake of the technology should continue to increase across the market. This has the potential to play a crucial role in understanding human health and disease progression. In our view, significant demand for sequencing tests should more than offset pricing pressures and may ultimately lead to the continuation of high growth in the sequencing market through to 2040.

Sources:

[1] National Human Genome Research Institute. Updated 6 November 2023. https://www.genome.gov/genetics-glossary/Base-Pair#:~:text=%E2%80%8BBase%20Pair&text=Attached%20to%20each%20sugar%20is,and%20cytosine%20pairs%20with%20guanine.

[2] Front Line Genomics. 26 July 2021. https://frontlinegenomics.com/a-brief-history-of-next-generation-sequencing-ngs/

[3] MIT Technology Review. 15 June 2015. https://www.technologyreview.com/lists-tr50/50-smartest-companies-2014/intro#Illumina

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. The securities mentioned are only for illustrating the investment process of Newton Investment Management. These opinions should not be construed as investment or any other advice and are subject to change. This material is for information purposes only and does not constitute an offer or solicitation to invest. This article was written by members of the NIMNA investment team. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.