After a prolonged period of relative underperformance, could emerging-market equities be set for a renaissance?

Key points

- We believe emerging-market (EM) equities may be at an inflection point for a period of sustained outperformance relative to their developed peers.

- The mid to long-term trajectory of the US dollar is likely to have a key bearing on the performance of EM equities over the next few months and years.

- Our view is that important components of the MSCI EM Index have already experienced a meaningful correction over the last few years, at least until a few months ago.

- We believe it is crucial for long-term EM investors to focus on three factors when assessing companies for investment: governance standards, business franchise strength, and growth-outlook resiliency.

Emerging-market (EM) equities had a good end to 2022. The MSCI EM Index was up +13.3% in US-dollar terms in the last two months of the year, outperforming the S&P 500 and MSCI World indices by 13.8% and 10.8% respectively.

In fact, the MSCI EM Index only marginally underperformed these other indices across the whole of 2022, which strikes us as counter to general perception in a year when China was touted as ‘uninvestible’ and Russian equity holdings were written down to zero. EM equities have also begun 2023 in robust fashion.

EM equities have been a laggard for so long that these bursts of strong relative performance naturally beg the question: are we at an inflection point, and are we now set for a sustained period of EM outperformance?

Inflection point

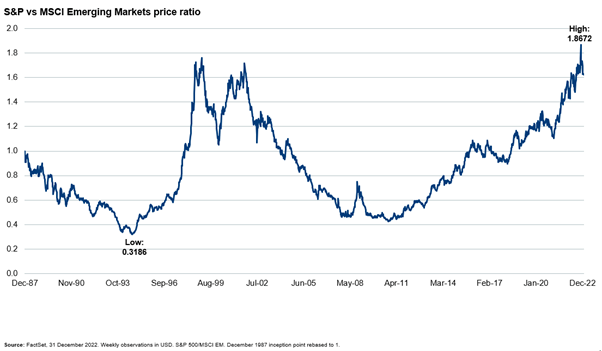

For us, the last potentially comparable inflection point was almost 12 years ago. Between October 2010 and October 2022, the MSCI EM Index returned a meagre 6.9% in US-dollar terms, or 0.6% annualised. This trailed the S&P 500 and MSCI World indices by 308% and 173% respectively, over the same period. We have not seen an outperformance or underperformance cycle of this duration since the MSCI EM Index was created, and the scale of the underperformance relative to the S&P 500 reached its widest extremity in October 2022 – see chart 1 below.

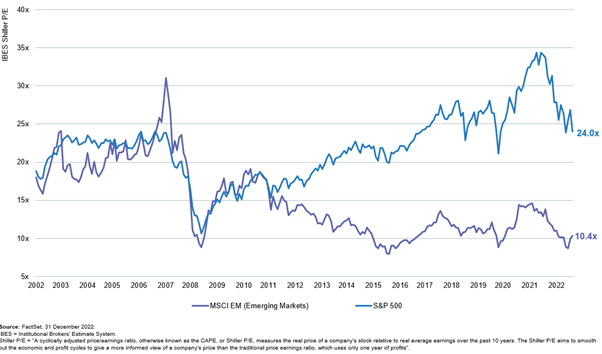

Furthermore, the relative discount of the MSCI EM Index is also at historically elevated levels. As at December 2022, it trades at a cyclically adjusted price-to-earnings (CAPE) ratio of 10.4 times, versus 24 times for the S&P 500, as observed in chart 2 below. It is hardly surprising that many market participants would start to consider an inflection point in favour of EMs.

Chart 1: S&P 500 Index versus MSCI EM Index price ratio (MSCI EM Index inception to December 2022)

Chart 2: S&P 500 and MSCI EM CAPE ratio (2002 to 2022)

The role of currency in relative performance of EM equities

Currency moves are, of course, important for the performance of EM equities. JP Morgan’s EM Currency Index fell by 55% from its peak in May 2011 to its trough in October 2022, or by 6.8% on an annualised basis. Hence, currency moves will account for a meaningful component of the MSCI EM Index’s underperformance in dollar terms during this time frame. But aside from a simple currency translation standpoint, we believe that pronounced local-currency weakness against the dollar can also bring risks to economic progress, corporate earnings and balance sheets in EMs. The strains of such currency weakness can be felt through inflation passthrough (and related tightening monetary policy responses), as well as through financial strains felt by institutions encumbered with dollar-based debt and liabilities.

And so, for us, the outlook for EM equities is likely to be meaningfully influenced by the outlook for the US dollar. Indeed, we can see that the four distinct periods of relative performance for EMs since 1987 (two periods each of outperformance and underperformance) have been characterised by either a benign or weak dollar.

Lack of consensus on the dollar’s long-term trajectory

The smartest brains in global capital markets will always struggle to find a consensus around what might cause a secular dollar bull or bear market. Do we need a policy catalyst, such as 1985’s Plaza Accord?[1] Can we assume that purchasing power parity (PPP) conversion factors will trend towards 1.0 over the longer term in developing countries that are making genuine progress? Would structurally higher inflation in the US, versus major EM countries, be a game-changer for currencies? Are the monetary experiments since the global financial crisis of 2008 of any relevance to the currency outlook?

We are not sure, but we do think it pertinent to note the large twin deficit (current account and fiscal deficit combined) in recent years in the US, the custodian of the world’s reserve currency. This deficit almost reached 17% of GDP through the Covid-19 years of 2020-2021, versus typically around 5-7% in the seven years prior to this (albeit higher if you use the change in the national debt as a more accurate gauge of the fiscal deficit). Are these imbalances bullish for EM currencies, or physical assets, or potentially even both?

What will shift the needle in the EM index?

China is clearly a very important EM index constituent, composing roughly one third of the MSCI EM Index at the end of 2022. More broadly, the three North Asia regions of China, Taiwan and Korea, plus India, comprise a dominant 72% of the index, and it is therefore hard to see strong EM performance without most of these regions positively contributing.

It is also worth noting that EM equities are not the play on commodities that many think them to be. There are several standout resource-intensive economies in EMs; however, these four Asian regions, which comprise almost three quarters of the index, are predominantly commodity and energy importers.

From the perspective of sectors, technology and financials together represent over half of the MSCI EM Index. China’s online businesses are also key – we estimate that they represent close to 15% of the index. So, in the same way as we note the importance of those economies above, it is hard for the asset class to work well without technology, financials and China online businesses also performing.

We believe the allure here is in the fact that many of these important components of the EM index have already experienced a meaningful correction over the last few years, at least until a few months ago.

The short-term variables that preoccupy market participants

From a tactical perspective, perhaps looking 12 months out, our view is that relatively low valuations and beaten-up stocks alone do not guarantee strong performance. However, there are some obvious potential catalysts for EM equities that have started to play out in recent months:

- US consumer price inflation (CPI) has probably peaked, with headline CPI down from a high of 9.1% in June to 6.5% in December. While the Federal Reserve (Fed) appears to be set to raise rates further, it has already done a lot – raising the upper band from 0.25% to 4.5%. As the global macro slowdown finally starts to catch up with the US, during the final throes of Fed rate hikes, it is certainly plausible that market participants gain further conviction in a scenario where both the US dollar and US interest rates face sustainable downward pressure. This is usually a positive setup for EM equities. Both the US yield curve and the dollar have already been drifting lower in recent months, as we potentially move past peak rate expectations. Of course, it is far from clear whether US CPI can fall to and/or stabilise around the 2% targeted level; however, the stance that inflation remains stubbornly stuck above 2% strikes us as an already consensual point of view.

- EM countries are broadly ahead of the curve in this inflation cycle – almost every major EM region either has well-anchored low inflation or positive real rates (those few with higher inflation and negative real rates at least have higher real rates than the US). Granted, some countries, like Turkey, are experiencing dramatic unanchored inflation, but they do not represent meaningful parts of the index. Brazil, a typical weak link in EMs, has already hiked its policy rate from 2% to 13.75%, with headline CPI having fallen from 12.1% to 5.9%.

- Chinese government policy has clearly pivoted towards: i) reopening, versus strict Covid-19 containment; ii) supporting the real-estate industry, versus targeted industry rationalisation; and iii) supporting economic growth, versus addressing societal imbalances through a regulatory agenda against large companies. This pivot has become more obvious over the last few months, perhaps most notably on Boxing Day 2022, when China announced that, from 8 January, it would be scrapping quarantine requirements for those arriving from abroad, as well as for infected people domestically. The next few months in China will be difficult, with questions around whether the fragile real-estate industry can be rehabilitated, and with little signs yet of economic recovery. Furthermore, President Xi Jinping will not have permanently given up on his ambitions around addressing social tensions, nor reunification of Taiwan for that matter. Systemic mishaps can still occur in China’s imbalanced economy. However, the case remains clear to us that the near-term outlook has enormously improved following a clear policy pivot from the government.

What do we know?

We would suggest that readers treat our musings and constructive outlook for EM equities in 2023 with a good dose of scepticism. This is not just because we are preaching the same asset class that we manage, nor because we purport to be stock pickers with a long-term investment horizon, as opposed to tactical strategists, but mainly because it is very hard to get these year-by-year allocation calls right. We can see that relatively low valuations in EMs have now been met by potential catalysts in the form of a weaker dollar and better growth in China. However, we also appreciate that there are a multitude of variables that can undermine this rosy picture.

So, what do we believe with high conviction, then?

First, we think that EM equities are a worthwhile strategic allocation. EM and frontier countries account for two thirds of the world’s population, and a higher proportion of the world’s younger population. They account for around 38% of the world’s nominal GDP, a figure which is growing. This compares to a much higher 50.1% of the world’s PPP-adjusted GDP, which is a better reflection of the real volume of economic activity. Yet they encompass well under 10% of global capital allocations. These countries account for 58% of global CO2 emissions, and rising, so will be the necessary home for the majority of future energy-transition investments. For us, it is only in EMs that you can find such a range of opportunities, namely:

- The unparalleled ingredients for improving prosperity and a growing middle class in countries like India and Indonesia

- The rich natural-resource endowments in regions like Latin America, the Middle East and North Africa

- The scale of continuing change in a mega economy like China’s

- The technology leadership from innovative companies in key strategic industries, especially in North Asia.

Secondly, we believe investors in EMs should tread with caution and a long-term mindset. We anticipate that winning companies will win by an extremely wide margin, especially in EMs. This is because many growth opportunities are still in their nascency, the cost of capital is high and volatile, economic cycles are more abrupt, and governance-related pitfalls are more common. For an investor committing capital to the region, we believe it is important to try to get the right side of these variables more often than not. It is impossible for an investor, or even a CEO, to know all the ins and outs of any portfolio company. In acceptance of this inevitable knowledge deficiency, we believe it is crucial to look at investment opportunities through an appropriate lens. For us, this means a focus on the following criteria:

- Governance standards: to ensure an alignment of interest with corporate decision-makers that we believe to be of high calibre in relation to their competence, vision and integrity

- Business franchise strength: we want to see a logical relationship between qualitative company attributes and quantitative financial outcomes, which, in turn, can provide comfort around the sustainability of healthy returns on invested capital

- Growth-outlook resiliency: this can be achieved through a deep understanding of durable secular trends (or themes) to seek to ensure that portfolio companies may enjoy tailwinds, as opposed to persistent growth headwinds that often induce unexpected (yet predictable) disappointments.

We use this lens to try to unearth what we believe to be the most likely winners: if you can identify those EM winners, and can buy them at a good price, we believe that you then need a sufficient investment horizon to allow those winners adequate time to pull away from their peers and for the market to fully recognise their achievements.

[1] The 1985 Plaza Accord saw the G5 nations of Germany, France, UK, US and Japan agree to manipulate exchange rates to depreciate the value of the US dollar versus the Japanese yen and German mark.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic structure the security has been assigned to. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments