Key points

- Listed infrastructure has delivered a similar risk-reward profile to private infrastructure over the last decade.

- At the end of 2023, listed infrastructure traded at a 30% discount to private infrastructure, the largest discount since 2011, despite its greater liquidity, pricing transparency and ease of access into the asset class.1

- In public markets, investors can get instant access to investment opportunities in infrastructure securities, with the additional benefits of liquidity and pricing transparency.

The investment environment for private infrastructure has been challenging—interest rates are high, private-market multiples are elevated and historical hurdle rates are becoming more difficult to attain. At the same time, infrastructure deals in the private equity space have declined, leaving all-time-high levels of dry powder sitting on the sideline.

In our view, holding private capital reserves could lead to missed opportunities, particularly as infrastructure markets continue to be robust, boosted by tailwinds from deglobalisation, electrification and artificial intelligence (AI), which continue to drive electricity demand and investments. Given this backdrop, we believe now may be an opportune time for infrastructure investors to consider incorporating publicly listed infrastructure into their allocations, as either a complement to, or a substitute for, their unlisted infrastructure investments.

Advantages of listed infrastructure

Both listed and unlisted infrastructure offer investors similar characteristics: yield, capital gains, diversification and inflation-linkage. Separately, listed infrastructure has its own distinct set of advantages, including greater liquidity, readily available access to the market, and real-time pricing transparency. The ability to gain immediate exposure to the asset class can be particularly beneficial in this environment given the declining deal activity and long-term risk/return profiles of private infrastructure. Likewise, pricing transparency can be a key factor for investors in determining the true risks of their portfolios.

In a recent blog discussing the benefits of listed infrastructure, we highlighted the asset class’s relatively stable absolute and risk-adjusted returns throughout market cycles, its ability to pass inflationary pressures on to end consumers, and its stable cash flows that can provide downside support in difficult equity-market environments. Through listed infrastructure, investors can gain immediate beta exposure at lower valuations with greater pricing transparency and liquidity, while potentially earning similar returns.

Similar performance profiles

Up to the end of June 2024, indices tracking both listed and unlisted infrastructure posted a similar annualised return over the trailing ten years—the S&P Global Infrastructure Index (listed infrastructure) rose 4.6%, while the EDHEC Infra300® VW Equity Index (unlisted infrastructure) was up 5.2%, with similar risk (15.5% versus 15.4%, respectively).

With a similar risk/return profile, we believe listed infrastructure could provide a compelling solution for investors wanting exposure to the benefits of infrastructure while maintaining liquidity, pricing transparency and instant access to the asset class.

| Index | 10 Year annualised return | 10 Year standard deviation |

|---|---|---|

| Listed Infrastructure* | 4.6% | 15.5% |

| Private Infrastructure** | 5.2% | 15.4% |

**Source: Infra300 VW USD, Scientific Infra & Private Assets, infra300® 2024Q2 Release, https://publishing.edhecinfra.com/factsheets/Indices/Infra300_Report_2024Q2_Public.pdf.

Market access

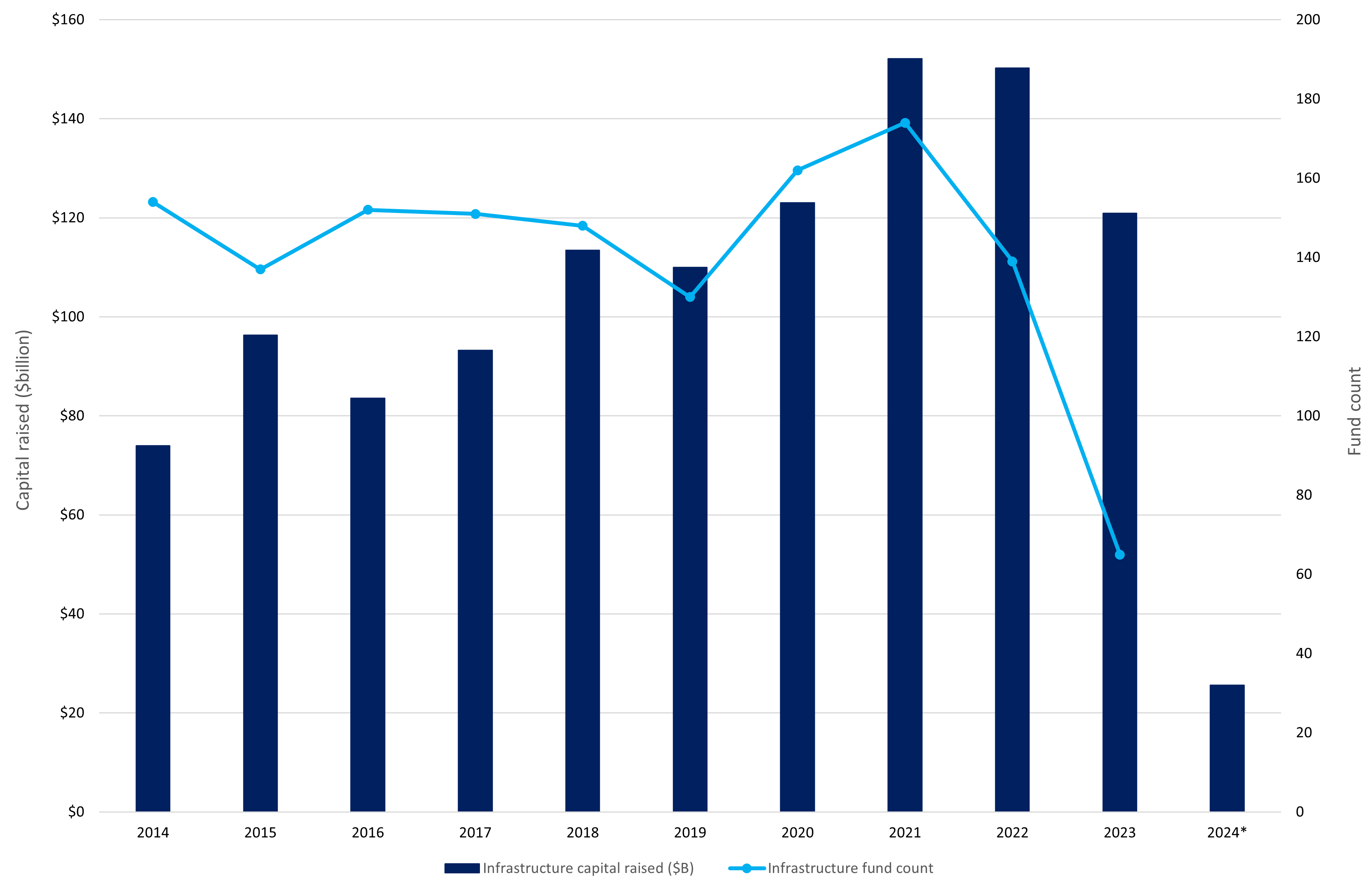

Private infrastructure has recently experienced a significant slowdown in deal activity. In 2023, fundraising dropped by 39.8% year over year and the number of vehicles reaching final close fell to its lowest level since Realfin began tracking in 1990, down 52%. The number of infrastructure deals declined by 18% in 2023 versus the previous year, and infrastructure merger-and-acquisition (M&A) transactions were down 41%.2,3 For committed capital to be deployed, the industry needs new infrastructure projects, new M&As and existing infrastructure to be sold to new buyers. If private infrastructure deal activity continues to lag, investors may struggle to find opportunities for putting their committed capital to work.

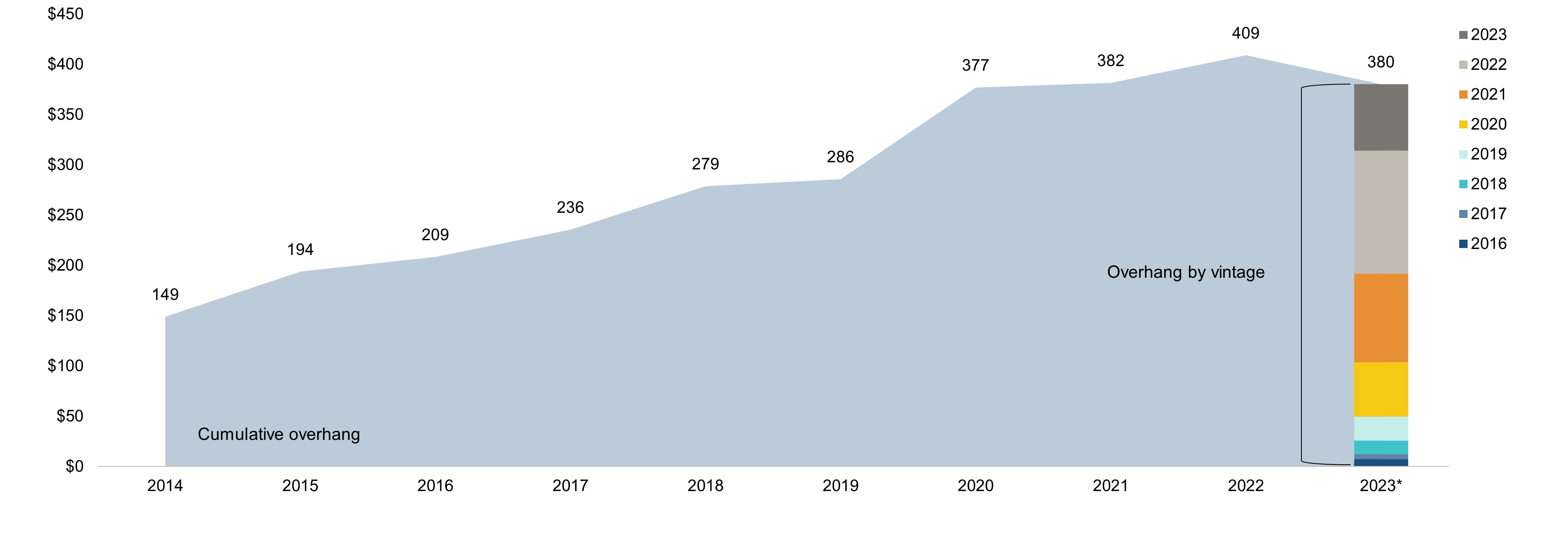

Meanwhile, dry powder has nearly tripled in less than a decade. A large sum of the 2020-2022 vintages have yet to be allocated to infrastructure projects, according to PitchBook Data, Inc.4 In our view, there are missed opportunities here, given that infrastructure equities have risen 30% since the end of 2020 (7.5% annualised).5

Infrastructure dry powder ($bn) by vintage

Source: PitchBook Data, Inc. As at 30 September 2023.

The higher interest-rate environment and greater valuation multiples have hindered fresh capital deployment in private infrastructure. Similarly, these challenges have also weighed on the fundraising environment.

Infrastructure fundraising activity

Source: PitchBook Data, Inc. As at 31 March 2024.

In public markets, investors can get instant access to investment opportunities in infrastructure securities, with the additional benefits of liquidity and pricing transparency. In our view, deal activity for existing private infrastructure is likely to remain challenged with record dry powder on the sidelines, owing to the appreciation in private infrastructure valuations over the last decade, combined with higher interest rates. To attract new investors, private infrastructure valuations must compress to listed valuation levels, which would result in lower returns for existing investors. Also, private infrastructure deals for the foreseeable future are likely to be financed at higher interest rates than the deals transacted over the last ten years, which could make historical hurdle rates difficult to attain.

Valuation multiples

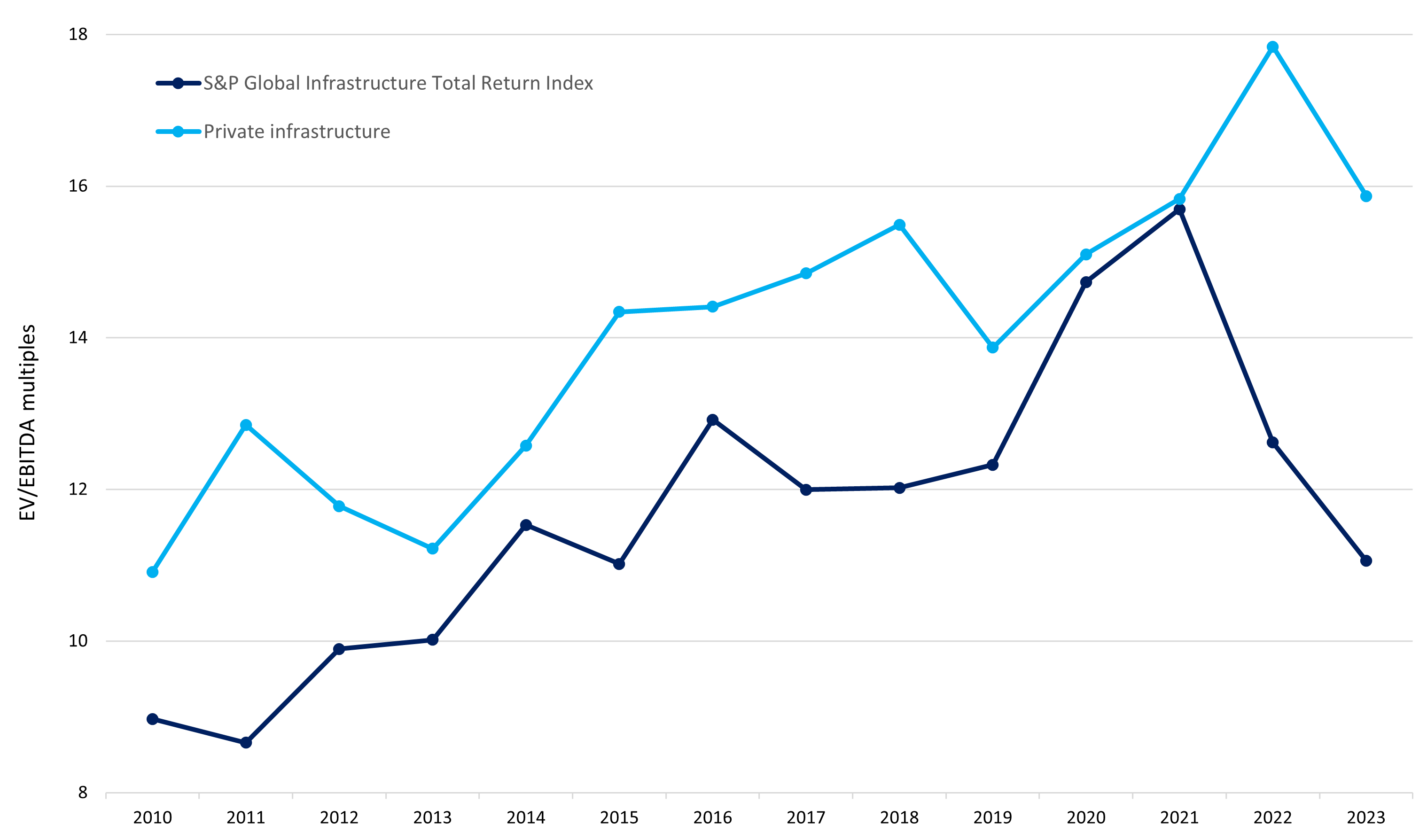

Valuation multiples in private infrastructure began to fall in 2023, partially owing to a downward adjustment in asset owners’ return expectations in the current rate environment. Valuations ended the year with a mean of 15.9 times EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation and amortisation). This is down from 17.8 times in 2022 and closer to the 2018-2022 five-year average of 15.6 times. Realfin predicts a continued downward trend in EV/EBITDA multiples, as “some of these drivers have only just begun exerting their influence on the market.”6 We believe this could lead to continued downward pressure on the return outlook for unlisted infrastructure, which has already fallen from their 2022 highs.

Given its real-time pricing and transparency, we believe listed infrastructure has already factored in the higher rate environment, following a 30% derating from 2021 to 2023; in comparison, private infrastructure experienced an 11% derating from 2022 to 2023. At the end of 2023, listed infrastructure traded at a 30% discount to private infrastructure, the largest discount since 2011, despite its greater liquidity, pricing transparency and ease of access into the asset class.7

Over the last ten-plus years, the market environment was favourable for private infrastructure. Investors could take on leverage at very low rates, buy relatively cheap and exit at higher multiples, as multiples generally rose during this period (from 11 times EV/EBITDA in 2010 to 18 times in 2022).8 However, with higher interest rates (at around 6%), all-time high levels of dry powder, lower transaction activity and higher multiples (at 16 times EV/EBITDA), private infrastructure investors are currently facing a much more difficult environment and may have to lower their return expectations.

In our view, investors who had committed capital sitting on the sidelines over the last three years may have missed out on investing in listed infrastructure. Of the market’s $380 billion in dry powder, approximately 73% was raised from the start of 2021 until 30 September 2023, according to PitchBook Data, Inc.9 The listed infrastructure market has risen 30% from 2021 until July 2024. Given the macroeconomic backdrop, we believe unlisted multiples may continue to decline. At current relative multiples, now could be an opportune time for investors to consider reallocating some of their exposure from unlisted infrastructure to listed infrastructure, to capitalise on the valuation dislocation.

EV/EBITDA multiples

Source: Bloomberg, RealfinX Platform, 31 December 2023.

Liquidity

Whether investors choose to go all in with listed infrastructure or allocate a portion of their infrastructure exposure to the listed market, they may benefit from added liquidity. With dealmaking at a decade low, falling valuation multiples and declining return outlooks, due in part to higher rates, this liquidity provides investors with the opportunity to adjust the duration of their portfolios and access their capital. Furthermore, in these challenging markets, we have seen instances recently of redemption limits being set on private infrastructure assets. In our view, this further underscores the liquidity appeal of publicly listed infrastructure.

Pricing transparency

Valuing unlisted infrastructure can be challenging, as it is difficult to accurately assess the immediate risk/reward profiles of these assets. We have spoken with numerous valuation accountants and auditors who have highlighted that private infrastructure asset owners are afforded more discretion and subjectivity in their reporting, particularly more freedom to take a longer-term view when valuing their assets. This can enable private infrastructure fund managers to immunise their assets from material decreases in valuation. The lack of transparency can cause investors to misinterpret the true risks of private infrastructure assets within their portfolios, as volatility measures may be subdued by opaque and misunderstood valuation guidelines.

On the other hand, listed infrastructure offers real-time transparency with daily mark-to-market valuations, which we believe provide a more accurate depiction of associated risks. This was evident during the Covid-19 pandemic, when publicly listed equities were down over 30% while private benchmarks were down just 10%. As there are very few fundamental differences between the underlying assets of listed and unlisted infrastructure, we would expect them to yield similar results. However, due to the opacity of private infrastructure reporting, including the lack of visibility into the process and massive amounts of discretion afforded to private infrastructure fund managers, private companies were able to smooth out their reported risks.

Reported volatility for listed infrastructure assets may be higher due to daily mark-to-market pricing, full transparency of underlying risks and the inability of fund managers to underplay risks in their reporting. However, we believe that through a full market cycle the true underlying risks and rewards of private and publicly listed infrastructure are very similar, as evidenced by the similar performance profiles of the EDHEC Infra300® VW Equity Index and the S&P Global Infrastructure Index over the last ten years.

Diversifying into listed infrastructure

At Newton, we value the ability to invest in infrastructure with liquidity and pricing transparency. Private market valuations may continue to contract, and this may drag on the return outlook for private infrastructure, particularly relative to the last decade. For these reasons, and given the macroeconomic regime change over the last few years, we believe now may be an opportune time for investors to consider including public infrastructure in their infrastructure allocations. Diversifying into listed infrastructure may allow investors to generate similar returns while more effectively assessing the risk/reward trade-off in their portfolios.

1 RealfinX Platform

2 BCG Global. 18 March 2024. A bump in the road: Private equity infrastructure investment set to rebound following slowdown in 2023. https://www.bcg.com/press/18march2024-private-equity-infrastructure-investment-set-to-rebound.

3 Realfin. Realfin state of the market report global infrastructure 2024. Accessed 26 June 2024. https://realfinprodstorage.blob.core.windows.net/files/2024_Realfin_State_of_Market_Global_Infrastructure_2.1.pdf?utm_source=Newsletter&utm_medium=email&utm_content=Your+requested+link+to+Realfin+State+of+the+Market+-+Global+Infrastructure+2024&utm_campaign=2024-RSOM-INFRA+auto+responder+%28LinkedIn%29&vgo_ee=tYgLHu%2FNcFOMhVXSkAwUbZ2xjW%2F%2FmBpfsftcfiDUixxku8Omw5k%2F51pdRtxq%2F1MK%3AqJkmYXlRoq3Zl9HjWeykIV6YVDQGCKA9.

4 PitchBook. As at 30 September 2023.

5 Bloomberg. Accessed 26 June 2024.

6 Realfin. Private infrastructure multiples cool in 2023. 30 January 2024. https://www.realfin.com/intelligence/private-infrastructure-multiples-cool-in-2023?utm_source=Newsletter&utm_medium=email&utm_content=Private+infrastructure+multiples+cool+in+2023&utm_campaign=2024-01-31+RWIB-INFRA

7 RealfinX Platform

8 RealfinX Platform

9 PitchBook. As at 30 September 2023.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. This article was written by members of the NIMNA investment team. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. MAR006573 Exp 09/29.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments