Key points

- We remain bullish on artificial intelligence (AI) and believe agents (software applications capable of running tasks on their own) and on-device AI will broaden the investment opportunity set.

- In our view, AI will transform everything we touch—our personal devices, work devices, cars and homes—driving a significant hardware upgrade cycle as AI chips are installed to allow data analysis and decision making to occur on our devices.

- AI is providing investment tailwinds beyond the technology sector as the second-order impacts of AI influence areas such as infrastructure, utilities, industrials and nuclear power.

- The disruptive nature of AI presents an opportunity for active stock pickers to benefit from the rapid transformation that will allow both established and emerging organisations to build and scale thriving new businesses.

At Newton, we harness our multidimensional research capabilities to investigate key long-term trends that we believe will be instrumental in shaping the investment landscape over the coming years. Since 2022, the topic of artificial intelligence (AI) has never been far from the headlines, generating both huge excitement and deep concern.

AI is set to expand to new areas and enable significant advancements by creating user-friendly connections between people and advanced tech, with productivity and value creation set to skyrocket across industries. AI has the potential to change everything consumers touch, as technology and functionality continue to converge. AI application has broadened considerably in 2024; we expect this to continue into 2025 and beyond. AI looks set to transform essentially everything we touch, from our personal devices, work devices, cars and homes. The technology will continue to evolve as AI agents (software applications capable of running tasks on their own) extend their capabilities from assistance to action.

The modern software and data ‘stack’ is poised to change. Winning technology companies are likely to be vertically integrated, which will tend to favour large caps over small caps. Scale in computing by leveraging the cloud will also be compounded by companies that have the resources to deliver processing close to customers. Moving more resources to the edge, or even into the hands of users through local devices, can shape new winners in the next phase of the AI theme.

AI is also spreading beyond the technology sector as the second-order impacts are beginning to be felt in areas such as infrastructure, utilities, industrials, and nuclear power.

Not to be outdone by the private sector, government engagement in AI is poised to create a second wave of AI progress. Nations are starting to see both the benefits and risks of AI, understanding its impact on economic growth and national security. Consequently, more countries are developing their own AI infrastructure and capabilities to boost competitiveness and ensure future security.

Evolving AI use cases: agents, real-time language translation, education

AI is breaking out of its limited scope of assistance to engage more and more of the world through action.

Large language models (LLMs) have opened up a new frontier for AI to assist with productivity, including potentially replacing manual jobs that have a high propensity for errors. Large action models (LAMs) will take the baton from LLMs and keep the momentum going for AI into 2025. LAMs combine the language of LLMs with the ability to make decisions autonomously. They are also used in creating agents. LAMs can understand human intentions and can be trained for specific tasks using specific applications.

Over the next decade, we may see the rise of entire agent ecosystems—vast networks of interconnected AI that will push enterprises to think about their intelligence and automation strategy in a fundamentally different way.

An AI agent interacts with its environment, gathers data, and uses it to carry out self-chosen tasks to reach set objectives. Humans set the goals, but the AI agent independently selects the best actions to achieve them.

Agents are possible owing to the many innovations and advancements across technology, including a significant increase in data to analyse, driven in part by an increasing number of connected devices from the internet of things, exponential data growth from generative AI, and progress in algorithms. Together with increased processing capacity on smaller chips that reduces latency for real-time AI, this all leads to improved response times and reliability.

Agent applications

Education is an area of significant opportunity for AI agents to break down barriers and democratise education globally, helping to customise education to the student based on their needs and progress. Using a machine-learning foundation, agents can analyse visual, auditory, reading/writing and kinaesthetic learning patterns. They can decipher strengths and weaknesses and create customised curricula.

Another major advancement in AI is real-time language translation. Language is a significant barrier to learning and social interaction. Among the first applications of AI on mobile devices will be to break down linguistic barriers through real-time LLMs. Devices have the potential to become more intelligent, learning our patterns, routines, interactions and reactions to interactions, and will become platforms to enhance all aspects of our lives. Essentially, we could all have a supercomputer in our hand, in our ears, on our wrist, or as our eyes.

Broader agent themes

With more agents on our devices, we may also see an evolution from a graphical user interface (GUI) to a conversational user interface (CUI), which uses voice prompts to engage with LLMs and LAMs. Agents driven by LAMs embedded in our devices can act in real time by communicating with other LAMs and engaging with external systems (such as apps), making AI more functional for the general population.

In some form, agents will also be on our work computers, changing the way we interact with our computer by performing a myriad of tasks. The current limitations are around what we tell them to do. Over time, the capabilities will evolve and expand through machine and deep-learning techniques, and agents will interact with each other to make higher-level decisions and take more intuitive actions.

Having AI on devices, coupled with the rollout of 5G mobile networks and a proliferation of sensors, should drive growth in the ‘internet of things’ (connected devices), and enable more real-time data analysis and decision-making to take place at the ‘edge’ (i.e., in real time even at remote locations). We expect significant improvement in, for example, autonomous driving capabilities, and these developments also open the door for progress within health care, with better monitoring, treatment and detection. The advancements in safety and privacy alone should be noticeable.

We can envision a future in which everyday devices are transformed. We will also see many failures, and some will come to market before the ideal infrastructure and technology are ready. The possibility exists for one device with built-in internet access, driven by LLMs, LAMs and agents, which sees everything you see, hears everything you hear, and becomes your personal assistant and life coach. It could include biosensors to sense your mood, biometrics to measure your health, and facial recognition to tell you who people are (for those of us who are not good at remembering names).

Impact on power/electricity

The power sector has hit an inflection point, which has been driven by electrification, deglobalisation, and now the demand for and growth of AI. Throughout 2024, we have seen continued strength in the technology sector, but utilities have led the market. AI is providing an additional tailwind to the power market beyond the themes that were already in place.

The International Energy Agency’s (IEA) recently released Electricity 2024 report1 highlights:

- Global electricity demand is set to grow at a 3.4% compound annual growth rate (CAGR) from 2024-2026 compared to 2.2% and 2.4% in the prior two years.

- Electricity consumption from data centres, AI and cryptocurrency sectors could double from 460 terawatt hours (TWh) in 2022 to potentially 1,050 TWh in 2026.

- Global nuclear generation is set to grow 3% per year on average through 2026, surpassing the previous generation record last set in 2021.

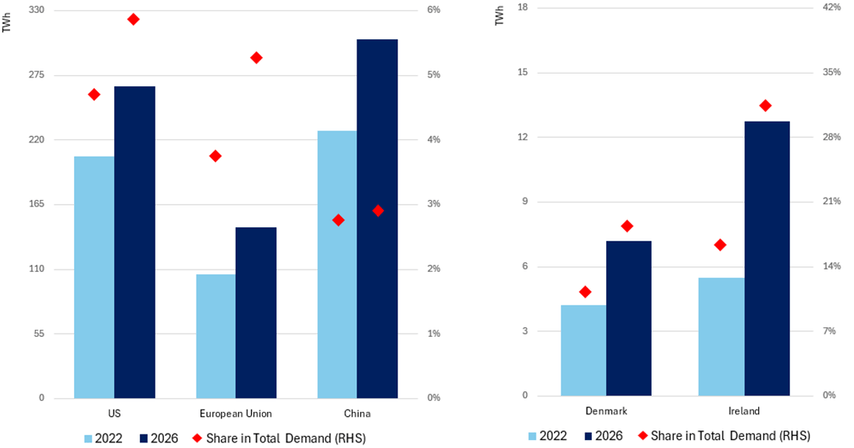

Data centres, AI and cryptocurrency already represent almost 2% of total global electricity demand, according to the report. This number could double to 4% in 2026 as data centres increase electricity devoted to computing and cooling. The US consumes the most energy, with its 33% of global data centres representing 4% of all US electricity demand, growing to 6% in 2026, while China and the European Union (EU) are forecast to grow their data-centre electricity consumption by 50% by 2026. Ireland’s data centres represent a whopping 17% of total electricity consumed in the country, which is forecast to increase to 32% over this time frame.

Estimated data centre electricity consumption and its share in total electricity demand in selected regions in 2022 and 2026

Source: International Energy Agency, Electricity 2024.

Given the global race for computing power, we expect this trend to continue well beyond 2025, creating second-order impacts in the AI ecosystem across areas such as energy, infrastructure, utilities and nuclear power. China recently communicated its desire to almost double its computing power by 2025, believing that, historically, every one yuan invested in computing power has driven three to four yuan of economic output.

The US CHIPS Act of 2022 provides $52 billion in manufacturing grants and subsidies along with a 25% investment tax credit to incentivise semiconductor manufacturing in the US, with the aim of increasing market share through revitalising US semiconductor manufacturing, strengthening the supply chain, and advancing national security. The EU passed its own European Chips Act in 2023 aimed at doubling Europe’s share of the global microchips market, with more than €43 billion of policy-driven investment to support the legislation until 2030, which is intended to be broadly matched by long-term private investment.

This global chip war and considerable government support should provide long-term tailwinds for the second-order effects of AI growth mentioned above. Nuclear power is one area of significant opportunity. The IEA’s updated Net Zero Roadmap estimates nuclear energy could more than double by 2050. Nuclear momentum really started to build at the COP28 climate change conference in December 2023, with over 22 countries aiming to triple nuclear capacity by 2050.

Sovereign AI

As the pivotal role of AI in our future becomes increasingly evident, states are preparing themselves against disruption by building their own AI algorithms and industries. Governments around the globe are ramping up their investment to enable the wide array of use cases, including the bolstering of critical areas of health care, energy and defence. Combined with the prospect of new forms of cyber risk from AI, increased regulatory scrutiny (e.g., the EU’s General Data Protection Regulation) is also a driving force in data-centre construction across the globe. The EU, for example, wants data centres close at hand to tighten compliance and security. We should expect regulatory scrutiny to continue and cannot rule out the prospect of additional fines or frameworks to control risk, though such measures could have the unintended risk of stifling innovation and further entrenching today’s incumbents. In Asia, Chinese companies may be expanding data-centre computing resources beyond the Chinese mainland owing to rising export restrictions by the West. These activities are likely to expand and diversify the growth of AI beyond today’s private-sector hyperscalers.

Conclusion

We are at a point of reinvention. Businesses will soon have powerful technologies that will boost human potential, productivity and creativity. Early adopters are leading the way into a new era where technology, ironically, is becoming more human.

Generative AI and transformer models have revolutionised technology, from chatbots like ChatGPT to more accessible, intelligent systems. While AI initially focused on automation, it is now enhancing our work, democratising technology, and making specialised knowledge more widely available. This shift is transforming organisations and markets, bridging gaps between humans and technology, and unlocking greater human potential.

AI may deliver financial impact through productivity, cost reduction and new sources of revenue. We expect the first two of those levers, productivity and cost savings, to drive margins higher as AI expands. AI may also be a source of deflation. Revenues may follow once enterprises see tangible internal successes and launch new products and services with integrated AI capabilities.

1Electricity 2024: Analysis and forecast to 2026, International Energy Agency.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. MAR006724 Exp 10/29.

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments